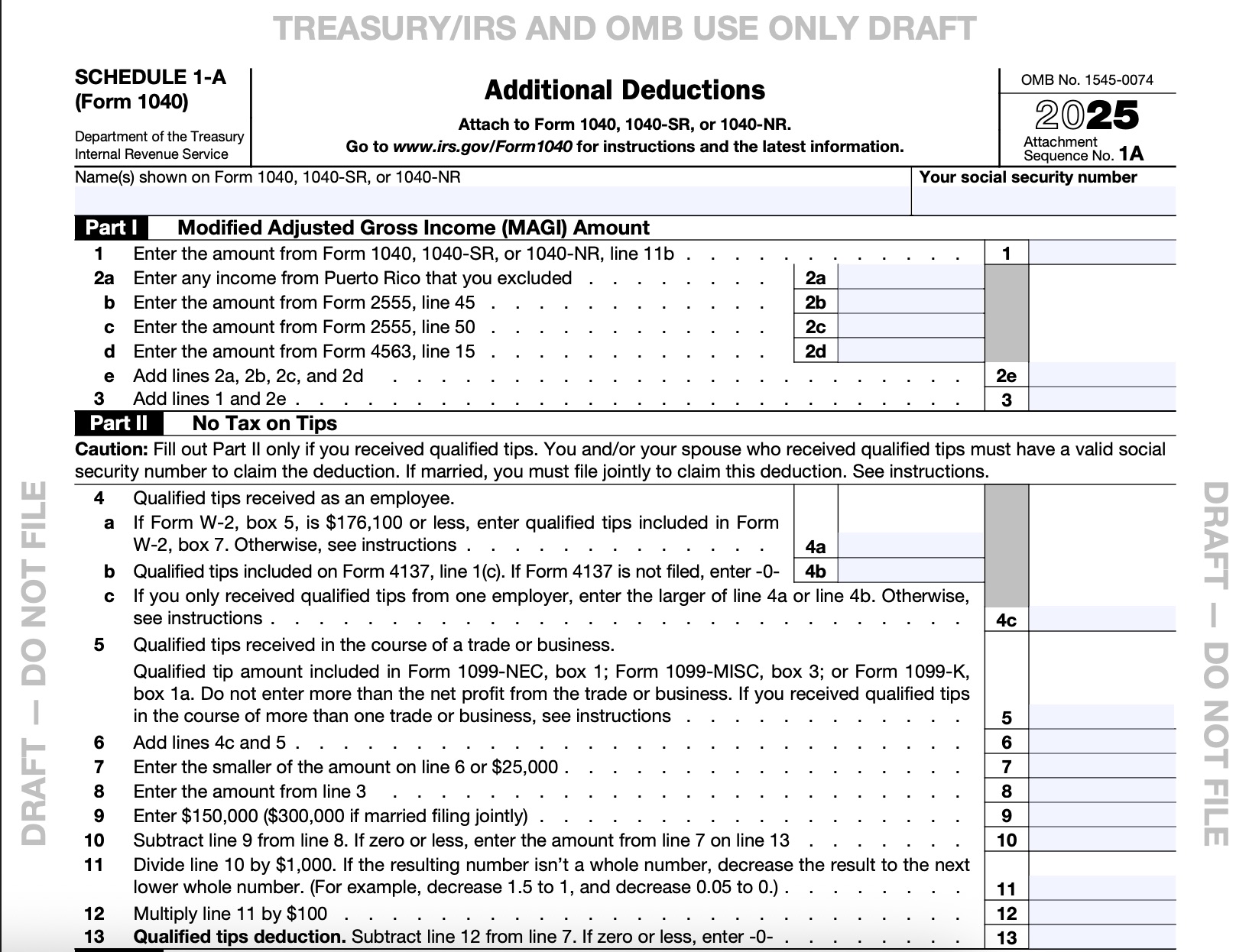

Filing your 2025 federal taxes in 2026 just got a major upgrade—and it could mean hundreds or even thousands back in your pocket. The IRS opened the 2026 filing season on January 26, and thanks to the One Big Beautiful Bill (signed into law July 4, 2025), there’s a shiny new form: Schedule 1-A (Form 1040).

This isn’t just another schedule—it’s your ticket to claiming four game-changing deductions that reduce your taxable income directly. We’re talking “no tax on tips,” “no tax on overtime,” interest on car loans, and an extra boost for seniors 65+. These perks are temporary (2025–2028 only), so don’t sleep on them!

Whether you’re a server pooling tips, a nurse pulling double shifts, a recent car buyer, or hitting retirement age, Schedule 1-A could slash your tax bill. Miss it, and you might overpay big time. In this guide, we’ll break it down step by step: what it is, who qualifies, how to claim each deduction, common pitfalls, and pro tips to maximize your refund.

Why Schedule 1-A Matters in 2026

Before the One Big Beautiful Bill, these targeted reliefs didn’t exist. Now, they’re “below-the-line” deductions—meaning they reduce your taxable income after calculating AGI (Adjusted Gross Income). You can claim them whether you take the standard deduction ($16,100 single/$32,200 joint for 2026 adjustments) or itemize—no conflict!

The form attaches to your Form 1040 (or 1040-SR), and the total flows to Line 13b (or equivalent) on your main return. Key: These only affect federal income tax—not payroll taxes (Social Security/Medicare) or state taxes (check your state’s rules).

The IRS has draft forms and instructions available, with transition relief for 2025 reporting (e.g., W-2s/1099s may not separate everything yet—use pay stubs or Form 4137 for tips).

The Four Main Deductions on Schedule 1-A

Here’s exactly what you can claim:

1. No Tax on Tips (Qualified Tips Deduction)

Up to $25,000 of qualified tipped income is deductible.

• Who qualifies? Workers in occupations that “customarily and regularly” received tips before 2025 (e.g., servers, bartenders, hair stylists, delivery drivers—full IRS list coming/available). Tips must be reported on W-2, 1099-NEC/MISC/K, or Form 4137.

• Limits: Max $25,000 (self-employed: can’t exceed net business income from tipping activity). Phases out if Modified AGI (MAGI) > $150,000 single/$300,000 joint (full phase-out details in instructions).

• Example: A bartender earns $18,000 in reported tips and has MAGI under $150K → deduct all $18,000, potentially saving ~$4,000+ in taxes (22% bracket).

• 2025 tip: Use pay stubs if employer reporting lags; full separate reporting starts 2026.

2. No Tax on Overtime (Qualified Overtime Compensation Deduction)

Deduct the premium portion of overtime (e.g., the extra “half” in time-and-a-half), up to $12,500 ($25,000 joint).

• Who qualifies? Anyone receiving FLSA-required overtime (reported on W-2/1099/other statements). Must have valid SSN.

• Limits: Same MAGI phase-out as tips ($150K/$300K). Only premium pay—not base rate or tips during OT.

• Example: Nurse earns $10,000 in premium OT pay (MAGI under threshold) → deduct $10,000, lowering taxable income and boosting refund.

• Pro note: 2025 transition relief applies—calculate from pay records if not separated on forms yet.

3. No Tax on Car Loan Interest (Qualified Passenger Vehicle Loan Interest – QPVLI)

Deduct interest paid on loans for qualified vehicles (cars, trucks, SUVs, minivans, motorcycles <14,000 lbs GVWR, final assembly in U.S.).

• Who qualifies? Personal-use loans after 2024; lender provides statement (by Jan 31, 2026, with transition relief—no penalties for delays).

• Limits: Up to certain caps (e.g., examples show phased reductions for higher interest); phases out based on MAGI/income tiers. Not full loan—only interest portion.

• Example: $50,000 qualified loan with $2,500 interest paid in 2025 → deduct eligible amount (watch for upside-down trade-ins—negative equity may not qualify).

• Watch out: Complex calc in draft form (excess over thresholds reduces by $200 increments).

4. Enhanced Deduction for Seniors

Extra $6,000 if age 65+ (or spouse 65+ if joint).

• Who qualifies? Valid SSN required; phases out at higher MAGI levels (similar structure).

• Example: Retiree couple both 65+ with moderate income → add $12,000 deduction, stacking with standard deduction.

How to Fill Out Schedule 1-A Step by Step

1. Start with MAGI calc (Part I): Use Form 1040 line 11b + add-backs.

2. For each deduction (Parts II–V): Enter qualifying amounts, apply caps/phase-outs.

3. Total all (line ~38) → transfer to Form 1040.

Download draft from IRS.gov (search “Schedule 1-A 2025”). Use tax software (TurboTax, etc.)—it handles calcs automatically.

Common Pitfalls & Warnings

• Phase-outs bite hard—track MAGI early (includes some exclusions).

• Reporting gaps in 2025—gather pay stubs/W-2s; penalties waived for some.

• Still pay FICA—tips/OT subject to Social Security/Medicare.

• State taxes vary—some conform, others don’t.

• Sunset in 2028—claim now!

• Eligibility strict—e.g., vehicle must be U.S.-assembled; tips in qualifying jobs only.

Pro Tips to Maximize Your Refund

• Gather docs now: W-2s, 1099s, lender statements, pay stubs.

• Use IRS Free File or software for accuracy.

• If complex (self-employed, high income), consult a tax pro.

• Check IRS.gov/One-Big-Beautiful-Bill-Provisions for updates.

• File early—refunds faster with direct deposit!

Schedule 1-A is one of the biggest wins for working Americans in years. If you’re eligible for any of these, it could seriously boost your 2025 refund.

Which deduction are you claiming—or most excited about? Drop a comment below (tips? OT? car loan? senior boost?), share your biggest question, or tag a friend who needs this! Let’s help each other navigate 2026 tax season. 👇

For more tax tips, follow for daily updates, and subscribe for next week’s deep dive. Happy filing—may your refund be huge!

Leave a Reply