As tax season kicks off on January 26, 2026, for your 2025 returns, Schedule F (Form 1040) could be your secret weapon for turning farm profits—or even losses—into serious savings. But get it wrong, and you might face audits, penalties, or missed refunds. Whether you’re a full-time farmer, a rancher, or running a small agribusiness, this form is essential for reporting income and expenses from farming activities. In this comprehensive guide, we’ll break down everything you need to know about Schedule F for the 2025 tax year, including key updates from recent legislation like the One Big Beautiful Bill Act (OBBBA). We’ll cover eligibility, accounting methods, a line-by-line walkthrough, special deductions, common pitfalls, and pro tips to maximize your benefits. By the end, you’ll be equipped to file confidently—or know when to consult a tax pro.

If you’re new to farming taxes, don’t worry: We’ll keep it straightforward, with real-world examples like a Midwest corn farmer deducting equipment costs or a California vineyard owner handling crop insurance. And if you’re wondering, “Could this save me thousands?”—the answer is often yes, especially with 2025’s restored 100% bonus depreciation and expanded expensing limits. Let’s dive in.

What Is Schedule F and Who Needs to File It?

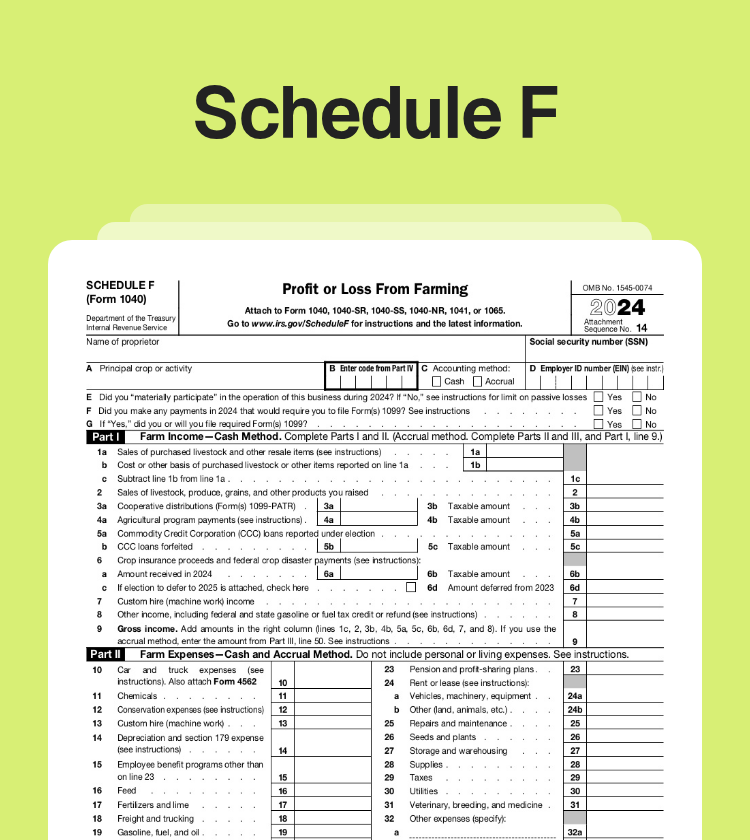

Schedule F, officially titled “Profit or Loss From Farming,” is an attachment to your main tax return—typically Form 1040, 1040-SR (for seniors), 1040-NR (nonresidents), 1041 (estates/trusts), or even 1065 (partnerships). Its primary purpose is to calculate your net profit or loss from farming operations and transfer that figure to your overall tax return. This net amount affects your taxable income, self-employment taxes (via Schedule SE), and potential eligibility for credits like the Earned Income Tax Credit (EITC) or Qualified Business Income Deduction (QBID).

Who files Schedule F? The IRS defines farming broadly to include cultivating soil, raising livestock, poultry, fish, or bees; operating nurseries or greenhouses; or producing crops, timber, or horticultural products. Even if farming isn’t your main gig—say, you’re a hobby farmer with a side orchard—you might need to file if you have income or expenses to report. Key thresholds: If your gross farm income is $600 or more, or you have significant expenses, you’re likely required. Single-member LLCs in agriculture often use Schedule F too, treating the business as a sole proprietorship.

Important distinction: If you’re just renting out farmland (as a landlord), use Schedule E instead. But if you’re actively involved—making decisions on planting, harvesting, or livestock management—you’re probably a farmer under IRS rules. The IRS uses a “material participation” test: You must be involved regularly, continuously, and substantially (e.g., at least 500 hours per year or the majority of the work). Fail this, and your losses might be treated as passive, limiting deductions against other income.

For 2025, no major structural changes to the form itself, but updates in related rules (like depreciation) make it more taxpayer-friendly. If you’re filing for the first time, gather records: Sales receipts, expense logs, depreciation schedules, and any government payments (e.g., from USDA programs).

Key 2025 Tax Changes Affecting Schedule F Filers

The 2025 tax year brings several farmer-friendly updates, largely thanks to the OBBBA, signed into law in 2025. This bill aimed to boost economic growth, including permanent relief for small businesses and agriculture. Here’s what’s new and noteworthy:

• Restored 100% Bonus Depreciation: For qualified property acquired and placed in service after January 19, 2025, you can now deduct 100% of the cost in the first year—up from the pre-OBBBA phase-down to 40% for 2025. This includes machinery, equipment, barns, and even certain improvements to farmland. Example: Buy a $200,000 tractor in February 2025? Deduct the full amount immediately, slashing your taxable income. Property must be new or used, with a recovery period of 20 years or less. Watch the acquisition date—pre-January 19 purchases fall under old rules.

• Expanded Section 179 Expensing: The maximum deduction jumps to $2,500,000 for 2025, with a phase-out threshold of $4,000,000 in qualifying property placed in service. These limits are now permanent and indexed for inflation annually. Unlike bonus depreciation, Section 179 applies to both new and used items, including heavy SUVs over 6,000 lbs. (up to $30,600 limit). If your total purchases exceed $4M, the deduction reduces dollar-for-dollar. Pro tip: Combine with bonus depreciation for maximum savings—use Section 179 first for items you want to expense fully.

• Qualified Business Income Deduction (QBID): Still at 20% for eligible pass-through businesses like farms, but it expires after December 31, 2025, unless extended. For farmers, this deduction applies to net qualified business income (QBI) from Schedule F, reducing taxable income (not AGI). Limitations kick in at higher incomes ($191,950 single/$383,900 joint, adjusted for inflation). Specified agricultural cooperatives get special rules—consult Form 8995 or 8995-A. If you’re a patron of a co-op, you might need to adjust for domestic production activities.

• Excess Business Loss Limitation: Noncorporate taxpayers can deduct farm losses only up to $313,000 (single) or $626,000 (married filing jointly) against non-business income. Excesses carry forward as net operating losses (NOLs). This is inflation-adjusted from 2024’s $289K/$578K.

• Cash Accounting Threshold: Farms with average annual gross receipts of $31 million or less (over the prior three years) can use the cash method, simplifying reporting. Larger operations must use accrual, but exceptions apply for family farms.

• Other Perks: Enhanced drought relief for forced livestock sales (defer gains via Form 4684), reforestation deductions up to $10,000, and energy-efficient property credits (e.g., via Form 7205). OBBBA also boosts the state and local tax (SALT) deduction cap to $40,000 through 2029, helpful if you itemize property taxes on farmland.

These changes could mean bigger refunds or lower bills—especially if you’re investing in equipment amid rising input costs. But they add complexity; track purchases meticulously.

Cash vs. Accrual Accounting: Choosing the Right Method

Your accounting method dictates when you report income and expenses, impacting your tax liability.

• Cash Method: Report income when received and expenses when paid. Ideal for small farms—it’s simple and allows deferring income (e.g., sell crops in December but deposit in January). Most farmers qualify if gross receipts are under $31 million. Exceptions: Farming syndicates or corporations must use accrual.

• Accrual Method: Report income when earned (e.g., when crops are sold, even if payment is later) and expenses when incurred. Better for matching revenues to costs but more paperwork. You can elect to defer crop insurance proceeds or disaster payments to the next year if using accrual.

Switching methods? File Form 3115 for IRS approval. For 2025, if you’re accrual-based, consider electing out of uniform capitalization rules for certain plants (saving on inventory costs). Example: A cash-method dairy farmer deducts feed bought in December 2025, even if used in 2026.

Line-by-Line Walkthrough of Schedule F

Schedule F has three parts: Part I (Farm Income—Cash Method), Part II (Farm Expenses), and Part III (Farm Income—Accrual Method). Use the method that matches your accounting. All lines reference the 2025 form.

Part I: Farm Income (Cash Method)

• Line 1: Sales of purchased livestock and items. Report gross sales minus cost basis (e.g., bought calves for $5,000, sold for $8,000? Report $8,000 here; deduct costs in Part II).

• Line 2: Sales of raised livestock, produce, etc. Full sales amount for items you raised.

• Lines 3-4: Cooperative distributions and agricultural program payments. Include Form 1099-PATR amounts; some are taxable.

• Line 5: Commodity Credit Corporation (CCC) loans. Elect to report as income or treat as loans.

• Line 6: Crop insurance proceeds. Taxable unless elected to defer (for cash method, defer if 50%+ of crops damaged).

• Lines 7-8: Custom hire and other income. Machine work for others, rents tied to production.

• Line 9: Gross income. Sum of lines 1-8.

Part II: Farm Expenses

This is where deductions shine—subtract from gross income.

• Line 10: Car and truck expenses. Use actual (mileage logs) or standard rate ($0.67/mile for 2025, adjusted).

• Line 11: Chemicals. Fertilizers, pesticides—fully deductible.

• Line 12: Conservation expenses. Limited to 25% of gross farm income; excess carries forward. Includes soil/water conservation, erosion prevention.

• Line 13: Custom hire. Payments for machine work.

• Line 14: Depreciation and Section 179. Big one! Enter from Form 4562. Use 100% bonus for post-Jan 19 assets.

• Lines 15-20: Employee benefits, feed, fertilizers, freight, gasoline. Straightforward; prepaid feed/supplies limited to 50% of other expenses.

• Line 21: Insurance. Farm-related only (not health).

• Line 22: Interest. Mortgage and other business loans.

• Line 23: Labor hired. Wages, but not to family unless withheld.

• Lines 24-29: Rent, repairs, seeds, storage, supplies, taxes. Property taxes deductible here or itemized.

• Line 30: Utilities. Farm buildings/equipment.

• Line 31: Veterinary, breeding, medicine.

• Line 32: Other expenses. Catch-all (e.g., marketing, software).

• Line 33: Total expenses. Sum.

• Line 34: Net farm profit/loss. Gross minus expenses. If loss, check at-risk rules (Form 6198).

Part III: Farm Income (Accrual Method)

Similar to Part I but adjusts for inventory changes (lines 35-42). Ending inventory minus beginning, plus sales.

After completing, transfer net to Form 1040, line 8 (other income) or Schedule 1.

Special Deductions and Rules for Farmers

Beyond basics:

• Preproductive Period Expenses: Elect to capitalize or deduct costs for plants with >2-year preproductive period.

• NOL Carrybacks: Farmers can carry back NOLs 2 years (others forward only).

• Averaging Income: Use Schedule J to average farm income over 3 years, reducing brackets.

• Energy Credits: Deduct for solar, wind, or efficient buildings (Form 3468).

• Reforestation: Up to $10,000 amortized over 84 months.

QBID integrates here—20% of net profit, but phase-outs apply.

Common Pitfalls to Avoid

• Missing 1099s: If you paid $600+ to vendors, file 1099-NEC/MISC or face penalties.

• Passive vs. Active: Prove material participation to deduct losses fully.

• Inventory Errors: Accrual filers must value properly (cost or market).

• Hobby Loss Rules: If no profit intent, expenses limited to income.

• Audit Triggers: Large losses, high deductions—keep records 3-7 years.

Pro Tips for Maximizing Your 2025 Return

• Use software like TurboTax or QuickBooks for auto-calculations.

• Elect deferrals strategically for cash flow.

• Carry over unused conservation deductions.

• If eligible, join a co-op for QBID boosts.

• Consult a CPA for complex setups, like S-corps.

Ready to file? Share your biggest farming tax headache in the comments—I’ll tackle it next! Remember, this isn’t personalized advice; see a professional for your situation. With these 2025 updates, Schedule F could put more money back in your barn. Happy filing!

Leave a Reply