As we kick off 2026, millions of Americans over 65 are buzzing about a game-changing tax break that’s putting real money back in their pockets. Introduced under the One Big Beautiful Bill Act, this new $6,000 senior deduction is designed to ease the financial burden on retirees amid rising costs for healthcare, housing, and everyday essentials. But is it enough to offset inflation’s bite, or just a temporary band-aid? And could it signal a shift away from heavily taxing Social Security benefits? Let’s dive in, break down the details, and explore what this means for your wallet – with real examples to show the potential savings.

What Exactly Is the New Senior Deduction?

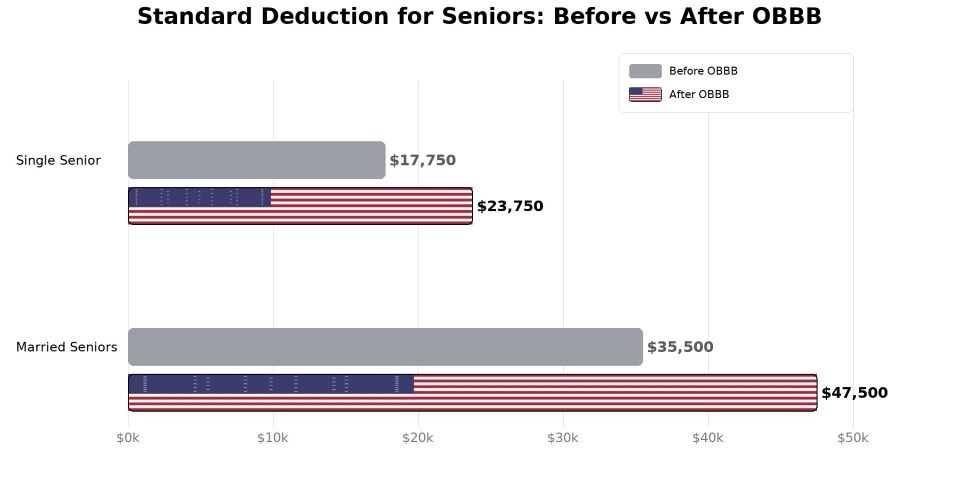

Unlike the longstanding additional standard deduction for those over 65 (which, for 2026, adds $2,050 for single filers or $1,650 per qualifying spouse for joint filers ), this is a brand-new above-the-line deduction worth up to $6,000 per eligible individual. For married couples where both partners are 65 or older, that doubles to $12,000.

It’s effective for tax years 2025 through 2028, meaning you can claim it on your 2025 return (filed in 2026) and beyond until it sunsets. The best part? It applies whether you itemize your deductions or take the standard deduction – making it accessible for most seniors who aren’t dealing with complex write-offs.

This deduction reduces your adjusted gross income (AGI) directly, which can lower your overall tax liability and even affect how much of your Social Security benefits are taxable. More on that intriguing angle later.

Who Qualifies? Eligibility Breakdown

To snag this deduction, you must:

• Be at least 65 years old by the last day of the tax year (December 31, 2026, for this year’s filing).

• Include your Social Security number on your tax return.

• If married, file jointly to claim it for both spouses (no married filing separately here).

Blind individuals over 65 can still claim their separate additional deduction on top of this – it’s not mutually exclusive. However, it’s not available for dependents or non-resident aliens.

Thought-provoking twist: In an era where people are working longer due to economic pressures, this age-based relief raises questions. Is 65 still the right benchmark for “senior” status when life expectancies are climbing? Or should it adjust for health and income needs?

The Phase-Out: Not Everyone Gets the Full $6,000

Here’s where it gets real – the deduction phases out based on your modified adjusted gross income (MAGI). For single filers, it starts shrinking once MAGI exceeds $75,000, fully disappearing at higher levels (exact phase-out range isn’t specified in IRS guidance, but it’s typically a gradual reduction). For joint filers, the threshold is $150,000.

This income-based limit means wealthier retirees might see little to no benefit, sparking debate: Is this truly helping the middle-class seniors who need it most, or favoring those already comfortable? If your income hovers around these thresholds, crunching the numbers early could reveal if slight adjustments (like Roth conversions) keep you eligible.

How to Claim It and Maximize Your Savings

Claiming is straightforward – it’ll be a line item on Form 1040, likely under “Other Adjustments.” No special forms needed, but you’ll want to use tax software or consult a pro to ensure accurate MAGI calculations.

Let’s make this tangible with examples (assuming 2026 tax brackets and a flat 12% effective rate for simplicity):

• Single Retiree, Age 67, MAGI $60,000: Full $6,000 deduction + $2,050 additional standard = Total extra deductions ~$8,050. Potential tax savings: $8,050 x 12% = ~$966. Add the base standard deduction of $16,100, and you’re shielding a hefty chunk of income.

• Married Couple, Both 68, MAGI $140,000: Full $12,000 + $3,300 additional standard ( $1,650 x 2 ). Savings: $15,300 x 12% = ~$1,836. But if MAGI hits $160,000, phase-out kicks in, reducing benefits.

• Edge Case: Single, Age 65, MAGI $80,000: Partial phase-out – say, half the deduction ($3,000). Savings drop to ~$360, highlighting how income planning matters.

These scenarios show real impact, but remember: Actual savings depend on your bracket and other factors. Tools like the IRS withholding estimator can help project.

Is This the End of Taxing Social Security? A Deeper Look

Social Security benefits can be taxable if your combined income exceeds certain thresholds ($25,000 single/$32,000 joint – unchanged for decades). By lowering AGI, this $6,000 deduction could push some folks below those limits, making more of their benefits tax-free.

With proposals floating to eliminate Social Security taxes altogether, is this deduction a stepping stone? Critics argue it’s too modest – $6,000 barely covers a year’s Medicare premiums for many. Supporters see it as targeted relief without bloating the deficit. What do you think: Fair fix or fleeting gesture?

Final Thoughts: Act Now to Capitalize

The new $6,000 senior deduction is a welcome boost for 2026 taxes, potentially saving eligible retirees hundreds or thousands. But with its phase-out and sunset date, it’s not a set-it-and-forget-it perk. Review your income sources, consider Roth strategies, and consult a tax advisor to maximize it.

Are you over 65 and planning to claim this? Share your thoughts in the comments – how much do you expect to save, and is it enough in today’s economy? Subscribe for more 2026 tax insights, and let’s make this filing season your best yet!

Disclaimer: This is not tax advice; consult a professional for personalized guidance.

Leave a Reply