Tax season for 2025 is here (returns due in 2026), and if you’ve got savings accounts earning interest, stocks paying dividends, or even a small foreign account, you might need to file Schedule B (Form 1040). Many people get 1099-INT or 1099-DIV forms in the mail and wonder: “Is this going to complicate my return?”

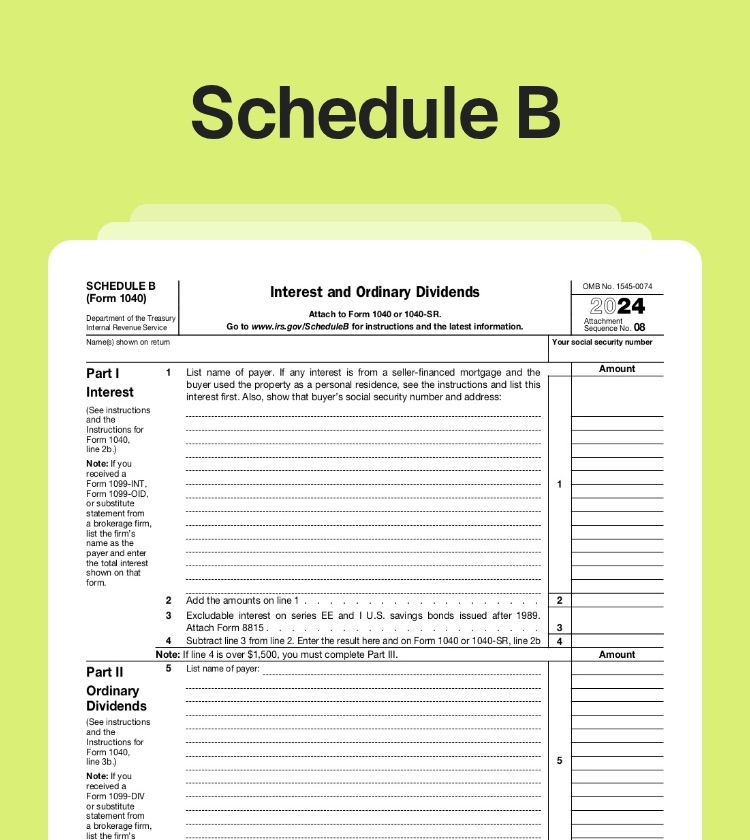

The good news? Schedule B is straightforward for most folks—it’s just an attachment to your Form 1040 that details taxable interest (Part I), ordinary dividends (Part II), and answers key questions about foreign accounts or trusts (Part III). You only need it if your taxable interest + ordinary dividends top $1,500, or if foreign financial interests apply.

In this guide, we’ll cover who must file Schedule B for tax year 2025, how to complete it step by step, pro tips to lower your taxes (especially on qualified dividends), and ways to stay audit-safe.

What Is Schedule B (Form 1040)?

Schedule B reports:

• Taxable interest from banks, CDs, bonds, etc. (Part I).

• Ordinary dividends from stocks, mutual funds, etc. (Part II).

• Foreign accounts and trusts (Part III – Yes/No questions that could require extra forms like FBAR).

Tax-exempt interest (e.g., from municipal bonds) skips Schedule B and goes straight to Form 1040, line 2a.

No big changes for tax year 2025—rules are consistent, with the $1,500 threshold holding steady.

Who Must File Schedule B for Tax Year 2025?

File and attach Schedule B if any of these hit for 2025:

• Total taxable interest + ordinary dividends > $1,500.

• You had a financial interest in (or signature authority over) a foreign financial account (even tiny ones count for the questions).

• Nominee distributions, seller-financed mortgage interest, accrued bond interest, OID adjustments, amortizable bond premium reductions, or Series EE/I savings bond education exclusions.

• Foreign trust distributions, grantor, or transferor status.

Even under $1,500? Still answer Part III if foreign accounts apply—skipping it risks penalties!

Step-by-Step: How to Fill Out Schedule B for 2025

Use your 1099s—tax software often imports them automatically.

Part I: Interest

1. Line 1: List each payer (e.g., bank name) and taxable interest from 1099-INT (usually box 1).

2. Line 2: Total line 1 amounts.

3. Adjustments: Subtract nominee amounts, accrued interest, etc. (label them).

4. Line 3: Exclude qualified Series EE/I bond interest for education (attach Form 8815).

5. Line 4: Final taxable interest → Transfer to Form 1040, line 2b.

Part II: Ordinary Dividends

1. Line 5: List payers and ordinary dividends from 1099-DIV (box 1a).

2. Line 6: Total (after adjustments) → Transfer to Form 1040, line 3b.

• Track qualified dividends (box 1b)—they qualify for lower rates!

Part III: Foreign Accounts and Trusts

• Line 7a: “Yes” if you had foreign account interest/signature authority in 2025.

• If aggregate value > $10,000 anytime → File separate FBAR (FinCEN 114) by April 15, 2026 (auto-extension to Oct. 15).

• List countries if needed.

• Line 8: Foreign trusts? May require Form 3520.

Double-check Part III—it’s a common oversight!

Tax-Saving Tips for Interest & Dividends in 2025

• Qualified dividends win big: These (U.S./qualified foreign stocks, held >60 days) are taxed at long-term capital gains rates (0%/15%/20%) vs. ordinary rates up to 37%. For 2025:

• 0% if taxable income ≤ $48,350 (single), $96,700 (joint).

• 15% for mid-range incomes.

• 20% for high earners. Hold investments longer to qualify!

• Shelter in tax-advantaged accounts: Roth IRA, traditional IRA, or 401(k)—future interest/dividends grow tax-deferred/free.

• Claim adjustments/credits: Amortize bond premiums, claim foreign tax credits (Form 1116) on withheld foreign taxes.

• Timing strategy: Manage income to stay in the 0% qualified bracket if possible.

Record-Keeping & Avoiding Red Flags

Save 1099s, statements, and docs for 3–7 years. IRS matches with payers, so mismatches trigger notices. Foreign questions? Answer honestly—penalties for non-compliance start high (FBAR civil fines up to $16k+ per violation).

Wrapping Up

For tax year 2025, Schedule B keeps reporting clean for interest and dividends—but foreign accounts add layers (and potential savings via credits). If your 1099s show over $1,500, qualified dividends, or overseas ties, get it right to avoid surprises.

Filed Schedule B last year? Hit any snags with qualified dividends or foreign questions? Share in the comments—I love hearing your stories and can help brainstorm strategies!

#TaxTips #ScheduleB2025 #QualifiedDividends #InterestIncome #TaxYear2025 #InvestingTaxes

Leave a Reply