Category: Tools & Resources

-

IRS Free File 2026: File Your 2025 Taxes Completely FREE – Save $50–$150+ This Season (Eligibility, Partners & Step-by-Step Guide)

Tax season kicked off early for many, and with the official 2026 filing opening on January 26, there’s no better time to ditch expensive software fees. IRS Free File is the IRS’s powerhouse program – a partnership with private companies – letting eligible taxpayers prepare and e-file federal returns at zero cost. Last year, millions…

-

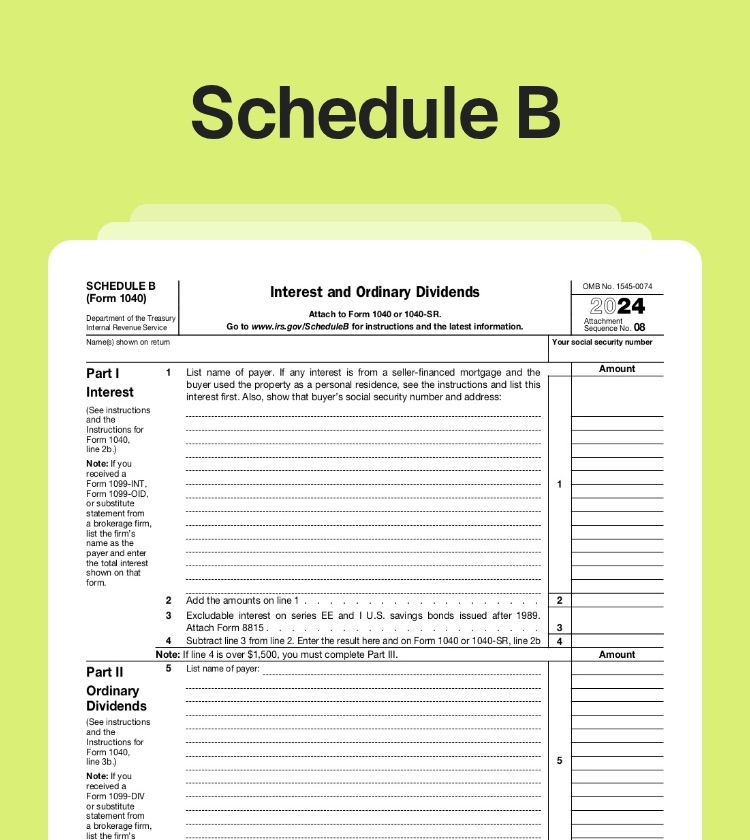

Schedule B Explained: Reporting Interest & Dividends for Tax Year 2025 – And How to Minimize Your Tax Bill

Tax season for 2025 is here (returns due in 2026), and if you’ve got savings accounts earning interest, stocks paying dividends, or even a small foreign account, you might need to file Schedule B (Form 1040). Many people get 1099-INT or 1099-DIV forms in the mail and wonder: “Is this going to complicate my return?”…

-

What Are Trump Accounts? A Complete Guide to the New Tax-Advantaged Savings for Children in 2026

Trump Accounts are a new type of tax-advantaged savings and investment account introduced under the One Big Beautiful Bill Act (OBBBA), signed into law on July 4, 2025. These accounts, also referred to as Section 530A accounts, function like traditional individual retirement accounts (IRAs) but are designed specifically for children under age 18. They aim…

-

5 Massive Tax Mistakes That Could Cost You Thousands in the 2026 Filing Season (And How to Avoid Them Before It’s Too Late)

Tax season is officially here—the IRS begins accepting 2025 returns on January 26, 2026, with the deadline looming on April 15. Thanks to the sweeping changes from the One Big Beautiful Bill (signed into law in 2025), millions could see bigger refunds through new perks like no tax on tips, no tax on overtime, no…

-

Tax Filing Season 2026: Your Essential Checklist to Gather Documents and Prepare Now

Tax season is just around the corner, and the IRS is already urging taxpayers to “Get Ready” for filing 2025 federal income tax returns. The 2026 filing season is expected to begin in late January (historically around late January to early February), with the standard deadline falling on April 15, 2026. Starting early isn’t about…

-

2026 Tax Changes: How Much More Money Will You Keep This Year?

As we ring in 2026, major updates to the U.S. tax code are kicking in—thanks to IRS inflation adjustments and key provisions from the One Big Beautiful Bill Act (OBBBA). These changes could mean bigger paychecks, larger refunds, and more opportunities to save on taxes. But are you positioned to take full advantage? The standard…

-

Crypto Tax Reporting in 2025 – New IRS Rules, Cost Basis Challenges, and Year-End Strategies

As cryptocurrency adoption surges into mainstream finance, the IRS has ramped up enforcement for 2025 reporting. With digital assets now firmly in the tax crosshairs, many holders face new Form 1099-DA requirements starting this year. If you’ve traded, staked, or even airdropped tokens in 2025, understanding these rules isn’t optional—it’s essential to avoid audits and…

-

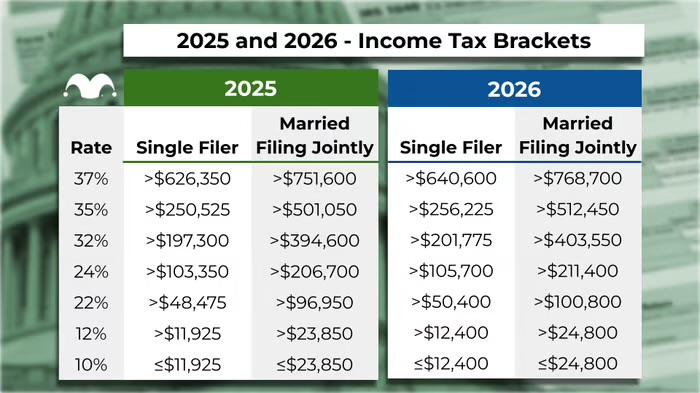

2026 Tax Brackets Are Here: Could You Owe Less (or More) Than You Think Next Year?

As we head into 2026, the IRS has released its annual inflation adjustments for federal income tax brackets, standard deductions, and other key provisions. Thanks to the One Big Beautiful Bill Act (OBBBA) passed in 2025, many of the popular tax cuts from the 2017 Tax Cuts and Jobs Act (TCJA) are now permanent—including the…