Category: Tax Planning

-

2025 Year-End Tax Checklist: 10 Must-Do Moves You Still Need to Review Before Filing in 2026 (Don’t Miss These!)

Missed a 2025 year-end tax strategy? This checklist covers capital loss harvesting, maxing retirement contributions, charitable bunching, and One Big Beautiful Bill changes to lower your 2026 tax bill. Act now!

-

7 Key Depreciation Options for Tax Year 2025: Maximize Deductions with 100% Bonus + $2.5M Section 179 (Before It’s Too Late!)

If you’re a small business owner, freelancer, or entrepreneur buying equipment, vehicles, or making improvements in 2025, the tax code just handed you a major win. Thanks to the One Big Beautiful Bill Act (OBBBA) signed in mid-2025, 100% bonus depreciation is back permanently for most assets placed in service after January 19, 2025—and Section…

-

Mastering Schedule C: The Ultimate Guide for Sole Proprietors and Gig Workers in 2025

If you’re running a business as a sole proprietor, freelancer, independent contractor, or gig worker, Schedule C (Form 1040) is essential. This form reports business income and expenses to the IRS, calculating net profit or loss that flows to your individual tax return. Proper completion can unlock significant deductions, reduce taxable income, and minimize self-employment…

-

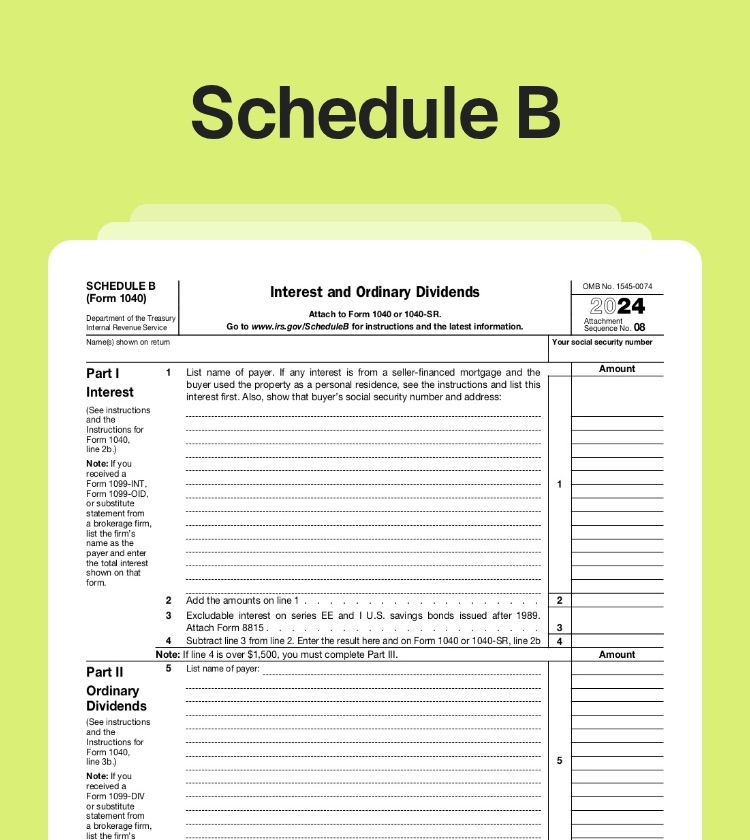

Schedule B Explained: Reporting Interest & Dividends for Tax Year 2025 – And How to Minimize Your Tax Bill

Tax season for 2025 is here (returns due in 2026), and if you’ve got savings accounts earning interest, stocks paying dividends, or even a small foreign account, you might need to file Schedule B (Form 1040). Many people get 1099-INT or 1099-DIV forms in the mail and wonder: “Is this going to complicate my return?”…

-

Schedule C 2026: The Ultimate Guide for Freelancers & Gig Workers – Maximize Deductions, Avoid Costly Mistakes, and Slash Your Tax Bill

As a freelancer, gig worker, Uber driver, consultant, or sole proprietor, you’re the boss — but Uncle Sam still wants his cut. That’s where Schedule C (Form 1040) comes in: your key to reporting business income and expenses, calculating profit or loss, and claiming powerful deductions that can dramatically reduce your taxable income. With the…

-

No Tax on Car Loan Interest in 2026: New IRS Rules Revealed – Save Up to $10,000 If You Bought (or Buy) a New American-Made Car!

The One Big Beautiful Bill (OBBBA), signed into law in 2025, delivered a surprise tax win for car buyers: a deduction for up to $10,000 in car loan interest paid each year on qualifying new vehicles. Often called the “no tax on car loan interest” break, it’s not a full exemption on payments — but…

-

Side Hustle Taxes in 2026: How Gig Workers Can Slash Bills with New Deductions & Avoid IRS Surprises

Earning extra cash on the side—whether driving for rideshare apps, freelancing on Upwork, selling handmade goods on Etsy, or delivering meals via DoorDash—has never been more popular. But with that income comes tax responsibilities, and 2026 brings some welcome relief thanks to the One Big Beautiful Bill Act (OBBBA), signed into law in 2025. The…

-

Tax Filing Season 2026: Your Essential Checklist to Gather Documents and Prepare Now

Tax season is just around the corner, and the IRS is already urging taxpayers to “Get Ready” for filing 2025 federal income tax returns. The 2026 filing season is expected to begin in late January (historically around late January to early February), with the standard deadline falling on April 15, 2026. Starting early isn’t about…

-

Will Your Paycheck Actually Grow in 2026? Breaking Down the New IRS Brackets and Trump’s Tax Cuts

Hey there, tax warriors! It’s January 7, 2026, and if you’re staring at your first paycheck of the year wondering, “Wait, is this bigger than last month—or am I just imagining it?” you’re not alone. With the IRS dropping fresh inflation adjustments and the One Big Beautiful Bill Act (OBBBA) kicking in some headline-grabbing changes,…

-

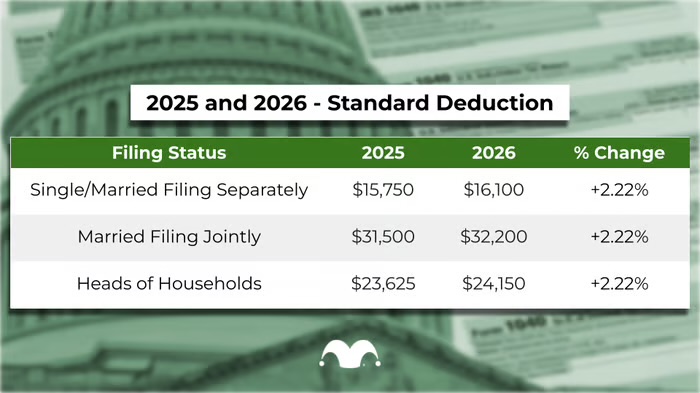

2026 Tax Brackets Released: Could Your Paycheck Get Bigger This Year?

The IRS has just unveiled the official 2026 tax brackets and inflation adjustments, incorporating key changes from the One Big Beautiful Bill Act (OBBBA). If your income doesn’t skyrocket with inflation, you could see a slightly larger paycheck—or a smaller tax bill—thanks to wider brackets and a boosted standard deduction. But here’s the thought-provoking question:…