Category: Tax News & Updates

-

IRS Free File 2026: File Your 2025 Taxes Completely FREE – Save $50–$150+ This Season (Eligibility, Partners & Step-by-Step Guide)

Tax season kicked off early for many, and with the official 2026 filing opening on January 26, there’s no better time to ditch expensive software fees. IRS Free File is the IRS’s powerhouse program – a partnership with private companies – letting eligible taxpayers prepare and e-file federal returns at zero cost. Last year, millions…

-

No Tax on Car Loan Interest in 2026: New IRS Rules Revealed – Save Up to $10,000 If You Bought (or Buy) a New American-Made Car!

The One Big Beautiful Bill (OBBBA), signed into law in 2025, delivered a surprise tax win for car buyers: a deduction for up to $10,000 in car loan interest paid each year on qualifying new vehicles. Often called the “no tax on car loan interest” break, it’s not a full exemption on payments — but…

-

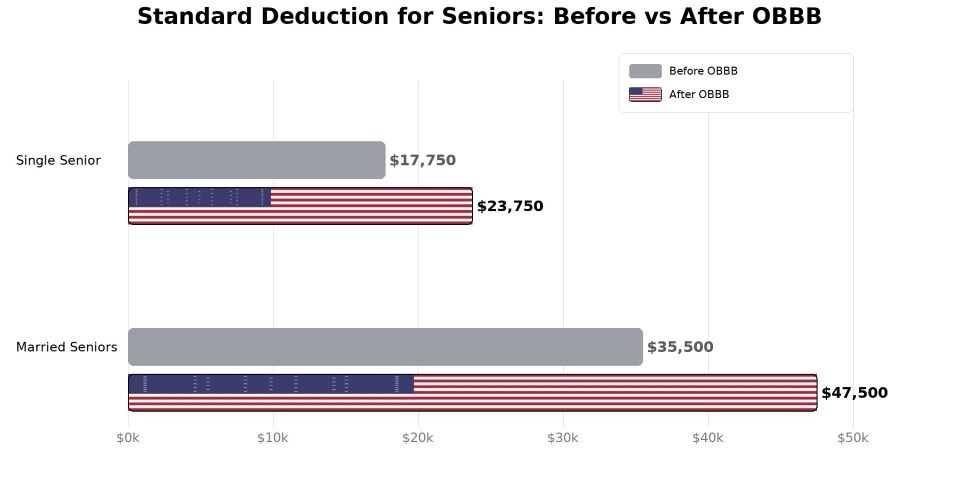

Unlock the New $6,000 Senior Tax Deduction in 2026: Could This Slash Your Tax Bill and Change How We View Retirement Income?

As we kick off 2026, millions of Americans over 65 are buzzing about a game-changing tax break that’s putting real money back in their pockets. Introduced under the One Big Beautiful Bill Act, this new $6,000 senior deduction is designed to ease the financial burden on retirees amid rising costs for healthcare, housing, and everyday…

-

No Tax on Overtime in 2026? The Truth Behind This Temporary Tax Break and How to Maximize It

As 2025 winds down, millions of hourly workers are buzzing about one of the hottest provisions from the One Big Beautiful Bill Act (OBBBA): the deduction for overtime pay. Often called “no tax on overtime,” this new rule lets eligible workers deduct up to $12,500 of qualified overtime income from their taxable earnings for tax…

-

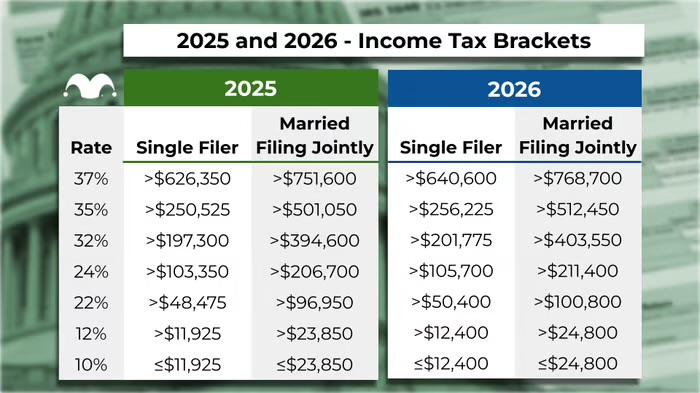

2026 Tax Brackets Are Here: Could You Owe Less (or More) Than You Think Next Year?

As we head into 2026, the IRS has released its annual inflation adjustments for federal income tax brackets, standard deductions, and other key provisions. Thanks to the One Big Beautiful Bill Act (OBBBA) passed in 2025, many of the popular tax cuts from the 2017 Tax Cuts and Jobs Act (TCJA) are now permanent—including the…

-

2025 Tax Law Changes from OBBBA: Key Updates and Year-End Moves to Maximize Savings

The One Big Beautiful Bill Act (OBBBA), signed into law on July 4, 2025, has reshaped the tax landscape by making many popular provisions from the 2017 Tax Cuts and Jobs Act (TCJA) permanent while introducing new deductions and credits. Instead of the feared “TCJA sunset” that would have raised rates and slashed deductions after…