Category: Tax Deductions

-

7 Key Depreciation Options for Tax Year 2025: Maximize Deductions with 100% Bonus + $2.5M Section 179 (Before It’s Too Late!)

If you’re a small business owner, freelancer, or entrepreneur buying equipment, vehicles, or making improvements in 2025, the tax code just handed you a major win. Thanks to the One Big Beautiful Bill Act (OBBBA) signed in mid-2025, 100% bonus depreciation is back permanently for most assets placed in service after January 19, 2025—and Section…

-

7 Massive 2025 Tax Changes from the One Big Beautiful Bill – Are You Missing Out on Thousands in Savings?

The “One Big Beautiful Bill Act” (signed into law on July 4, 2025) is already shaking up tax season for millions of Americans. This sweeping legislation makes many 2017 Tax Cuts and Jobs Act provisions permanent, while adding fresh breaks targeted at working families, seniors, and everyday earners. As we head into the 2025 filing…

-

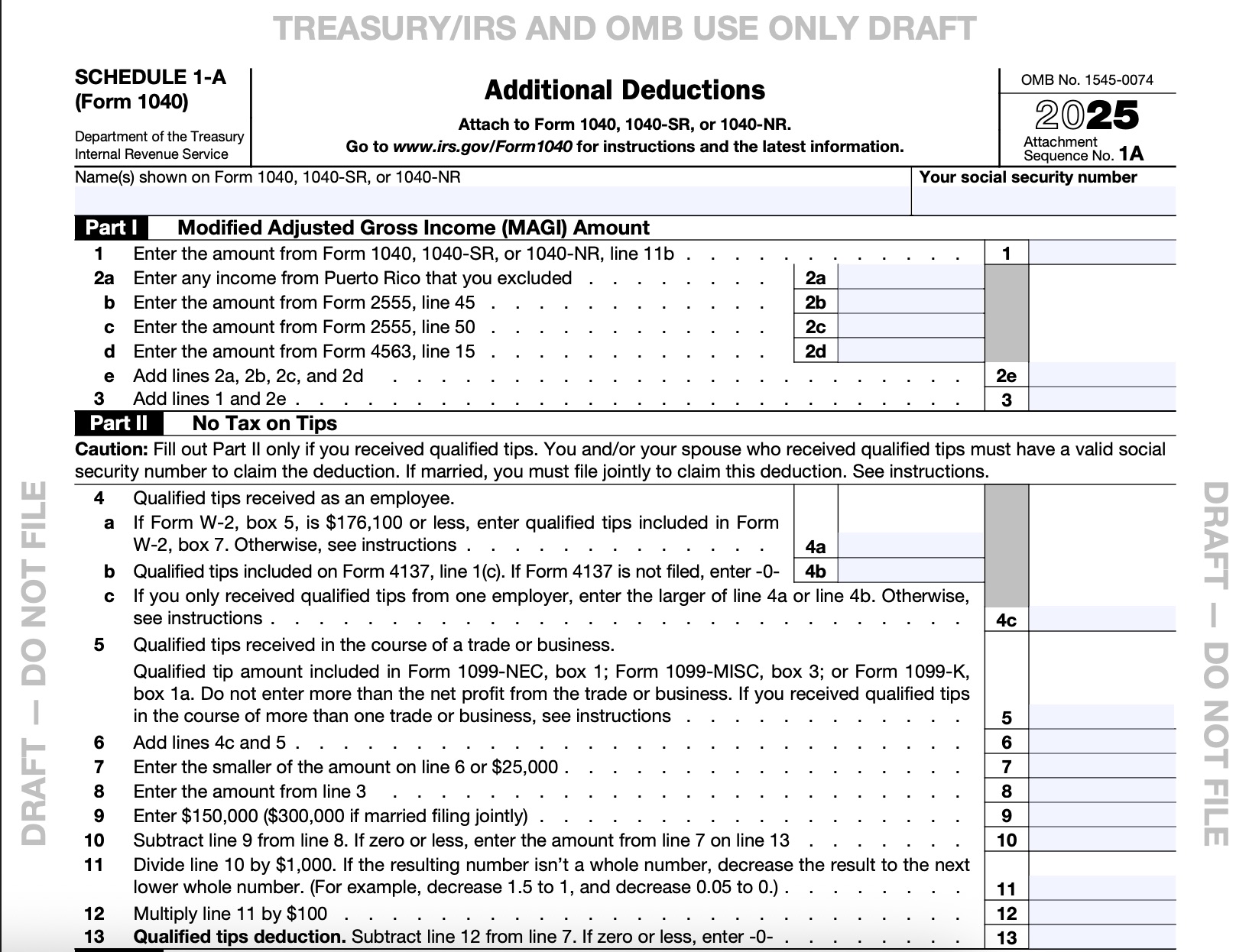

What Is IRS Schedule 1-A? Your Complete 2026 Guide to Claiming No Tax on Tips, Overtime, Car Loans & More (File Your 2025 Return Now!)

Filing your 2025 federal taxes in 2026 just got a major upgrade—and it could mean hundreds or even thousands back in your pocket. The IRS opened the 2026 filing season on January 26, and thanks to the One Big Beautiful Bill (signed into law July 4, 2025), there’s a shiny new form: Schedule 1-A (Form…

-

No Tax on Car Loan Interest in 2026: New IRS Rules Revealed – Save Up to $10,000 If You Bought (or Buy) a New American-Made Car!

The One Big Beautiful Bill (OBBBA), signed into law in 2025, delivered a surprise tax win for car buyers: a deduction for up to $10,000 in car loan interest paid each year on qualifying new vehicles. Often called the “no tax on car loan interest” break, it’s not a full exemption on payments — but…

-

Side Hustle Taxes in 2026: How Gig Workers Can Slash Bills with New Deductions & Avoid IRS Surprises

Earning extra cash on the side—whether driving for rideshare apps, freelancing on Upwork, selling handmade goods on Etsy, or delivering meals via DoorDash—has never been more popular. But with that income comes tax responsibilities, and 2026 brings some welcome relief thanks to the One Big Beautiful Bill Act (OBBBA), signed into law in 2025. The…

-

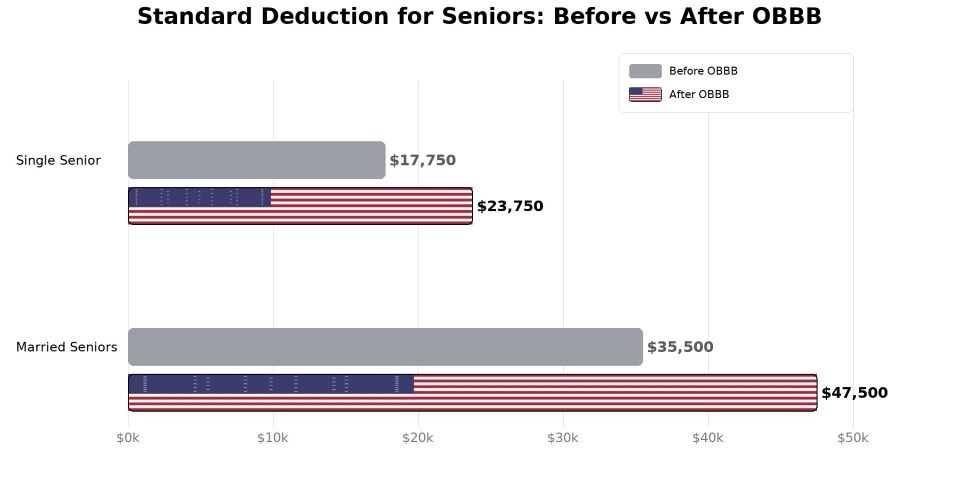

Unlock the New $6,000 Senior Tax Deduction in 2026: Could This Slash Your Tax Bill and Change How We View Retirement Income?

As we kick off 2026, millions of Americans over 65 are buzzing about a game-changing tax break that’s putting real money back in their pockets. Introduced under the One Big Beautiful Bill Act, this new $6,000 senior deduction is designed to ease the financial burden on retirees amid rising costs for healthcare, housing, and everyday…

-

The Revival of 100% Bonus Depreciation: A Permanent Win for Businesses in 2026

As we enter the 2026 tax year, one of the most powerful tax incentives for businesses is back—and this time, it’s here to stay. The One Big Beautiful Bill Act (OBBBA), signed into law on July 4, 2025, permanently restored 100% bonus depreciation under IRC Section 168(k). This reversal of the scheduled phase-out from the…

-

7 Surprising Tax Changes in 2026 That Could Save (or Cost) You Thousands – Are You Ready?

It’s January 2026, your first paycheck with new withholding just hit, and millions of Americans are about to feel the impact of the biggest tax overhaul in years. Thanks to IRS inflation adjustments and the new One Big Beautiful Bill (OBBB), your take-home pay, deductions, and planning strategy could look completely different. Some will save…

-

2026 401(k) Limits Just Jumped to $24,500 – Are You Missing Out on Free Tax Savings?

The IRS bumped employee contributions to $24,500 (plus bigger catch-ups for 50+). Maxing this could slash your tax bill by thousands – but only if you act now in January. As we dive into 2026, the IRS has delivered some welcome news for retirement savers: higher contribution limits for 401(k)s, IRAs, and other plans. These…

-

2026 Tax Changes: Will the New Standard Deduction Save You Thousands or Leave You Short?

Happy New Year! As we kick off 2026, major tax updates from the IRS inflation adjustments and the One Big Beautiful Bill Act (OBBBA) are now in effect. The headline change? The standard deduction has jumped significantly, potentially putting more money back in your pocket. But is it a game-changer for everyone—or could it fall…