Category: OBBBA

-

5 Surprising Tax Breaks from the One Big Beautiful Bill That Could Slash Your 2025 Tax Bill – Are You Missing Out?

As we approach the end of 2025, taxpayers across the country are gearing up for filing season in 2026. But this year is different: The One Big Beautiful Bill Act (OBBBA), signed into law on July 4, 2025, introduced a wave of new tax provisions—many effective retroactively for the 2025 tax year. These changes build…

-

7 Last-Minute Year-End Tax Moves to Slash Your 2025 Bill Before December 31 – Are You Missing Out on Thousands?

As 2025 draws to a close, the clock is ticking on powerful tax-saving opportunities under the current rules shaped by the One Big Beautiful Bill Act (OBBBA). With potential shifts looming in 2026—such as new limits on charitable deductions and changes to certain credits—acting now could save you thousands in taxes. These strategies are especially…

-

No Tax on Overtime in 2026? The Truth Behind This Temporary Tax Break and How to Maximize It

As 2025 winds down, millions of hourly workers are buzzing about one of the hottest provisions from the One Big Beautiful Bill Act (OBBBA): the deduction for overtime pay. Often called “no tax on overtime,” this new rule lets eligible workers deduct up to $12,500 of qualified overtime income from their taxable earnings for tax…

-

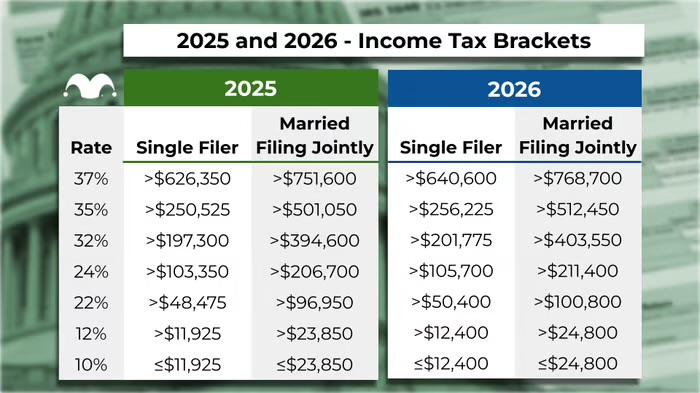

2026 Tax Brackets Are Here: Could You Owe Less (or More) Than You Think Next Year?

As we head into 2026, the IRS has released its annual inflation adjustments for federal income tax brackets, standard deductions, and other key provisions. Thanks to the One Big Beautiful Bill Act (OBBBA) passed in 2025, many of the popular tax cuts from the 2017 Tax Cuts and Jobs Act (TCJA) are now permanent—including the…

-

Lesser-Known OBBBA Provisions That Could Save You Big in 2025 – No Tax on Tips, Overtime Deductions, and More

With the One Big Beautiful Bill Act (OBBBA) now fully in effect, much attention has gone to the big-ticket items like permanent TCJA extensions and standard deduction boosts. But buried in the legislation are several targeted provisions that fly under the radar yet offer real savings—especially for workers in service industries, those putting in extra…