Category: OBBBA

-

7 Massive 2025 Tax Changes from the One Big Beautiful Bill – Are You Missing Out on Thousands in Savings?

The “One Big Beautiful Bill Act” (signed into law on July 4, 2025) is already shaking up tax season for millions of Americans. This sweeping legislation makes many 2017 Tax Cuts and Jobs Act provisions permanent, while adding fresh breaks targeted at working families, seniors, and everyday earners. As we head into the 2025 filing…

-

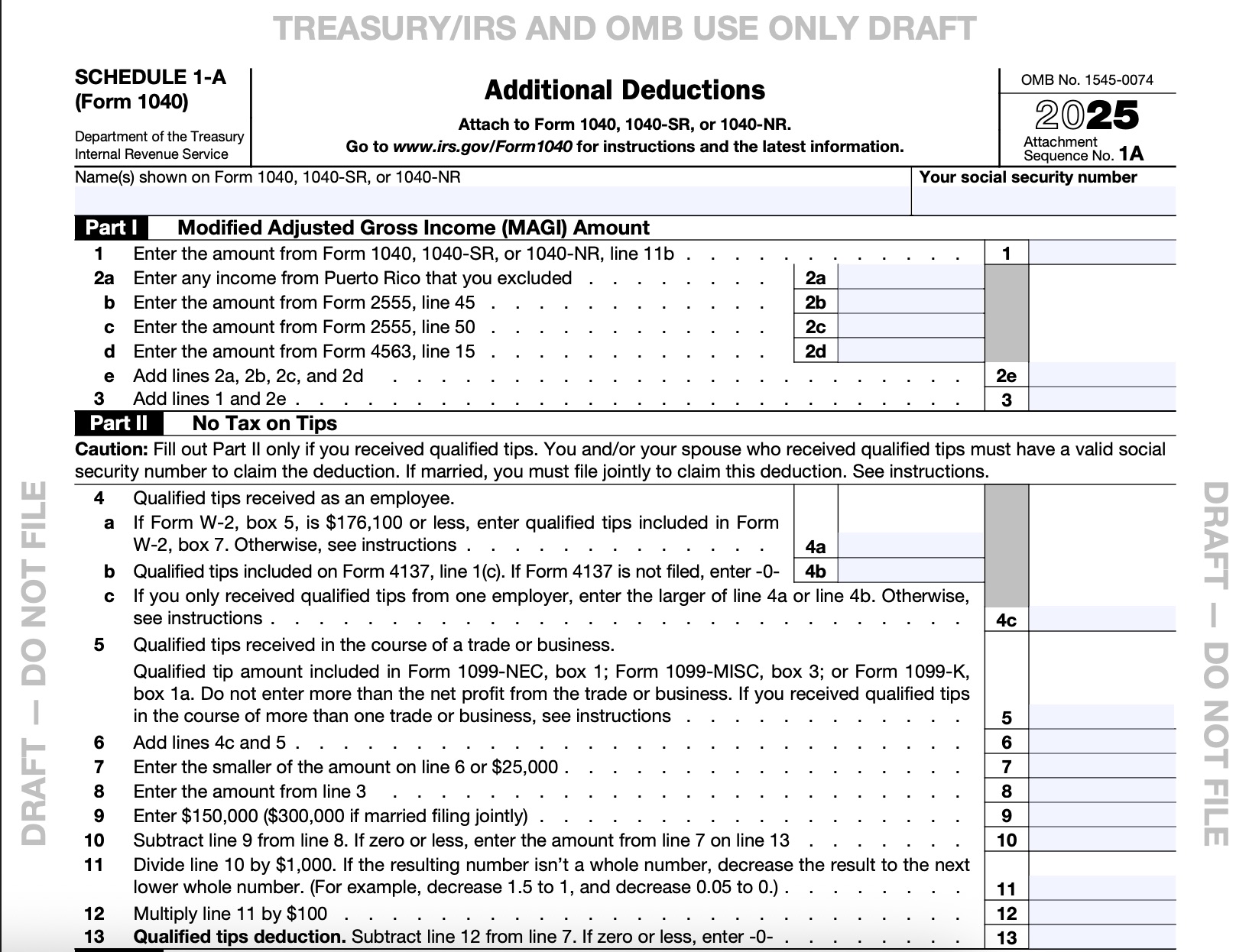

What Is IRS Schedule 1-A? Your Complete 2026 Guide to Claiming No Tax on Tips, Overtime, Car Loans & More (File Your 2025 Return Now!)

Filing your 2025 federal taxes in 2026 just got a major upgrade—and it could mean hundreds or even thousands back in your pocket. The IRS opened the 2026 filing season on January 26, and thanks to the One Big Beautiful Bill (signed into law July 4, 2025), there’s a shiny new form: Schedule 1-A (Form…

-

No Tax on Car Loan Interest in 2026: New IRS Rules Revealed – Save Up to $10,000 If You Bought (or Buy) a New American-Made Car!

The One Big Beautiful Bill (OBBBA), signed into law in 2025, delivered a surprise tax win for car buyers: a deduction for up to $10,000 in car loan interest paid each year on qualifying new vehicles. Often called the “no tax on car loan interest” break, it’s not a full exemption on payments — but…

-

What Are Trump Accounts? A Complete Guide to the New Tax-Advantaged Savings for Children in 2026

Trump Accounts are a new type of tax-advantaged savings and investment account introduced under the One Big Beautiful Bill Act (OBBBA), signed into law on July 4, 2025. These accounts, also referred to as Section 530A accounts, function like traditional individual retirement accounts (IRAs) but are designed specifically for children under age 18. They aim…

-

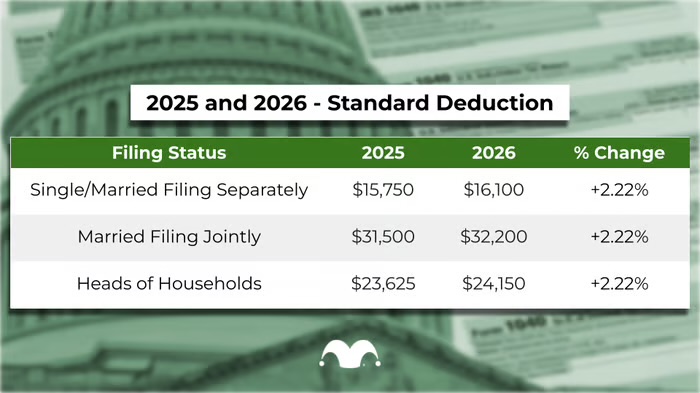

Will the 2026 Tax Changes Put More Money in Your Pocket This Year? Here’s What You Need to Know

Welcome to potentially bigger paychecks in 2026! If you’re like most Americans, you’ve probably heard the buzz about major tax updates kicking in this year, thanks to the One Big Beautiful Bill Act (signed into law in 2025) and the IRS’s annual inflation adjustments. These changes could mean more money in your pocket through higher…

-

Tax Filing Season 2026: Your Essential Checklist to Gather Documents and Prepare Now

Tax season is just around the corner, and the IRS is already urging taxpayers to “Get Ready” for filing 2025 federal income tax returns. The 2026 filing season is expected to begin in late January (historically around late January to early February), with the standard deadline falling on April 15, 2026. Starting early isn’t about…

-

Will Your Paycheck Actually Grow in 2026? Breaking Down the New IRS Brackets and Trump’s Tax Cuts

Hey there, tax warriors! It’s January 7, 2026, and if you’re staring at your first paycheck of the year wondering, “Wait, is this bigger than last month—or am I just imagining it?” you’re not alone. With the IRS dropping fresh inflation adjustments and the One Big Beautiful Bill Act (OBBBA) kicking in some headline-grabbing changes,…

-

2026 Tax Brackets Released: Could Your Paycheck Get Bigger This Year?

The IRS has just unveiled the official 2026 tax brackets and inflation adjustments, incorporating key changes from the One Big Beautiful Bill Act (OBBBA). If your income doesn’t skyrocket with inflation, you could see a slightly larger paycheck—or a smaller tax bill—thanks to wider brackets and a boosted standard deduction. But here’s the thought-provoking question:…

-

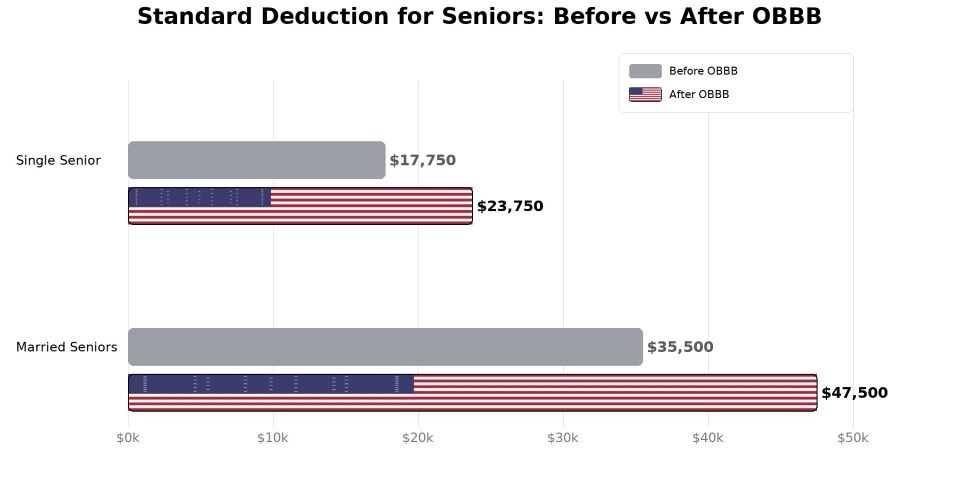

Unlock the New $6,000 Senior Tax Deduction in 2026: Could This Slash Your Tax Bill and Change How We View Retirement Income?

As we kick off 2026, millions of Americans over 65 are buzzing about a game-changing tax break that’s putting real money back in their pockets. Introduced under the One Big Beautiful Bill Act, this new $6,000 senior deduction is designed to ease the financial burden on retirees amid rising costs for healthcare, housing, and everyday…

-

The Revival of 100% Bonus Depreciation: A Permanent Win for Businesses in 2026

As we enter the 2026 tax year, one of the most powerful tax incentives for businesses is back—and this time, it’s here to stay. The One Big Beautiful Bill Act (OBBBA), signed into law on July 4, 2025, permanently restored 100% bonus depreciation under IRC Section 168(k). This reversal of the scheduled phase-out from the…