Category: Guides & Checklists

-

2025 Year-End Tax Checklist: 10 Must-Do Moves You Still Need to Review Before Filing in 2026 (Don’t Miss These!)

Missed a 2025 year-end tax strategy? This checklist covers capital loss harvesting, maxing retirement contributions, charitable bunching, and One Big Beautiful Bill changes to lower your 2026 tax bill. Act now!

-

Mastering Schedule C: The Ultimate Guide for Sole Proprietors and Gig Workers in 2025

If you’re running a business as a sole proprietor, freelancer, independent contractor, or gig worker, Schedule C (Form 1040) is essential. This form reports business income and expenses to the IRS, calculating net profit or loss that flows to your individual tax return. Proper completion can unlock significant deductions, reduce taxable income, and minimize self-employment…

-

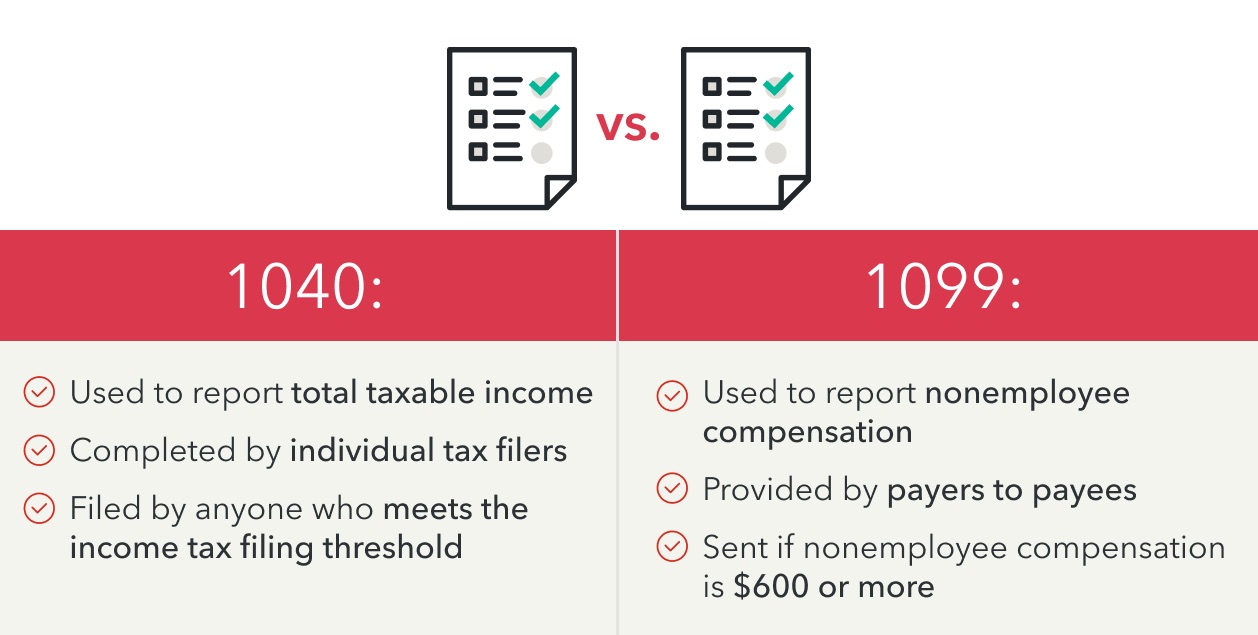

1099 Deadline Alert: February 2, 2026 Is Your Last Chance – Avoid Massive IRS Penalties on 1099-NEC & 1099-MISC!

Tax season is in full swing, and if you’re a small business owner, freelancer, or anyone dealing with independent contractors, the clock is ticking loudly. The key deadline for Form 1099-NEC (Nonemployee Compensation) and most Form 1099-MISC payments is fast approaching—and because January 31, 2026, falls on a Saturday, the IRS automatically shifts it to…

-

Biggest Schedule E Rental Property Deductions Every Landlord Should Claim in 2026!

As tax season heats up (filing officially starts January 26, 2026!), rental property owners have a golden opportunity to slash their taxable income. If you report rental income on Schedule E (Form 1040), you’re likely sitting on thousands in deductible expenses that most landlords overlook or misclassify. Rental income is taxable, but the IRS allows…

-

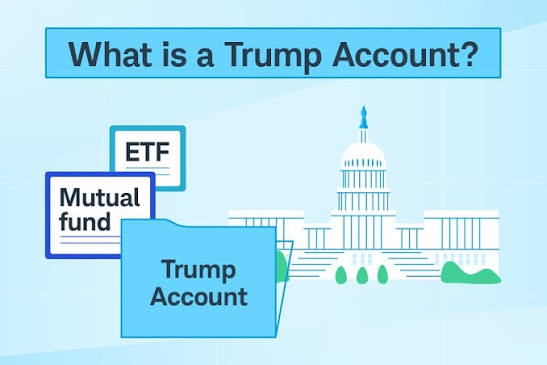

What Are Trump Accounts? A Complete Guide to the New Tax-Advantaged Savings for Children in 2026

Trump Accounts are a new type of tax-advantaged savings and investment account introduced under the One Big Beautiful Bill Act (OBBBA), signed into law on July 4, 2025. These accounts, also referred to as Section 530A accounts, function like traditional individual retirement accounts (IRAs) but are designed specifically for children under age 18. They aim…

-

5 Massive Tax Mistakes That Could Cost You Thousands in the 2026 Filing Season (And How to Avoid Them Before It’s Too Late)

Tax season is officially here—the IRS begins accepting 2025 returns on January 26, 2026, with the deadline looming on April 15. Thanks to the sweeping changes from the One Big Beautiful Bill (signed into law in 2025), millions could see bigger refunds through new perks like no tax on tips, no tax on overtime, no…

-

Tax Filing Season 2026: Your Essential Checklist to Gather Documents and Prepare Now

Tax season is just around the corner, and the IRS is already urging taxpayers to “Get Ready” for filing 2025 federal income tax returns. The 2026 filing season is expected to begin in late January (historically around late January to early February), with the standard deadline falling on April 15, 2026. Starting early isn’t about…

-

2026 Tax Changes: How Much More Money Will You Keep This Year?

As we ring in 2026, major updates to the U.S. tax code are kicking in—thanks to IRS inflation adjustments and key provisions from the One Big Beautiful Bill Act (OBBBA). These changes could mean bigger paychecks, larger refunds, and more opportunities to save on taxes. But are you positioned to take full advantage? The standard…

-

Last-Minute 2025 Tax Moves That Could Save You Thousands Before December 31 – Don’t Miss Out!

What if you could slash your 2025 tax bill by $5,000 or more in just the next few days? With only hours left until the calendar flips to 2026, there are still powerful, legal strategies you can use right now to lower your taxable income and boost your potential refund next year. Thanks to the…

-

5 Last-Minute Year-End Tax Moves for 2025 That Could Save You Thousands – Don’t Miss Out Before December 31!

As 2025 draws to a close, the clock is ticking on powerful tax-saving opportunities. With the One Big Beautiful Bill Act (OBBBA) bringing exciting changes like no tax on tips and overtime (for qualifying workers), a boosted SALT deduction cap, and enhanced benefits for seniors, there’s never been a better time to act. But some…