Category: Expense Tracking

-

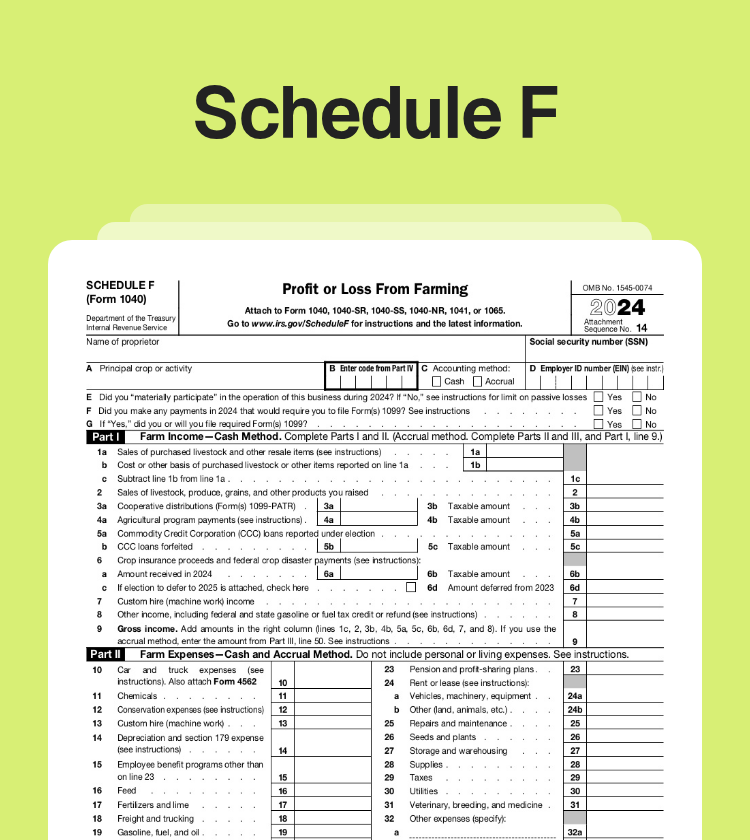

Unlocking Schedule F: Your Complete Guide to Reporting Farm Income and Slashing Taxes in 2026

As tax season kicks off on January 26, 2026, for your 2025 returns, Schedule F (Form 1040) could be your secret weapon for turning farm profits—or even losses—into serious savings. But get it wrong, and you might face audits, penalties, or missed refunds. Whether you’re a full-time farmer, a rancher, or running a small agribusiness,…

-

Schedule C 2026: The Ultimate Guide for Freelancers & Gig Workers – Maximize Deductions, Avoid Costly Mistakes, and Slash Your Tax Bill

As a freelancer, gig worker, Uber driver, consultant, or sole proprietor, you’re the boss — but Uncle Sam still wants his cut. That’s where Schedule C (Form 1040) comes in: your key to reporting business income and expenses, calculating profit or loss, and claiming powerful deductions that can dramatically reduce your taxable income. With the…

-

Biggest Schedule E Rental Property Deductions Every Landlord Should Claim in 2026!

As tax season heats up (filing officially starts January 26, 2026!), rental property owners have a golden opportunity to slash their taxable income. If you report rental income on Schedule E (Form 1040), you’re likely sitting on thousands in deductible expenses that most landlords overlook or misclassify. Rental income is taxable, but the IRS allows…

-

Maximizing Your Home Office Deduction for 2025: Key Rules and Strategies for Self-Employed Workers

With tax season just around the corner on this December 23, 2025, many freelancers, gig workers, and small business owners are reviewing their deductions to minimize what they owe. One of the most powerful—and often underutilized—tax breaks for those working from home is the home office deduction. If you qualify, this can significantly reduce your…

-

Why Mixing Personal and Business Finances Is a Tax Mistake

One of the most common tax mistakes among freelancers and small business owners is mixing personal and business finances. While it may seem harmless at first, this habit can lead to accounting errors, lost deductions, and problems if the IRS ever asks questions. What Does “Mixing Finances” Mean? Mixing finances happens when business income or…

-

Top Tax Deductions for Freelancers: The Ultimate 2025 Guide

Freelancers face a unique tax situation: you’re responsible for your own income tracking, quarterly taxes, and deductions. The good news? Freelancers also have access to powerful tax deductions that can significantly reduce taxable income — if you know what to claim. This guide breaks down the most important tax deductions every freelancer should know for…