Category: Business Deductions

-

7 Key Depreciation Options for Tax Year 2025: Maximize Deductions with 100% Bonus + $2.5M Section 179 (Before It’s Too Late!)

If you’re a small business owner, freelancer, or entrepreneur buying equipment, vehicles, or making improvements in 2025, the tax code just handed you a major win. Thanks to the One Big Beautiful Bill Act (OBBBA) signed in mid-2025, 100% bonus depreciation is back permanently for most assets placed in service after January 19, 2025—and Section…

-

Mastering Schedule C: The Ultimate Guide for Sole Proprietors and Gig Workers in 2025

If you’re running a business as a sole proprietor, freelancer, independent contractor, or gig worker, Schedule C (Form 1040) is essential. This form reports business income and expenses to the IRS, calculating net profit or loss that flows to your individual tax return. Proper completion can unlock significant deductions, reduce taxable income, and minimize self-employment…

-

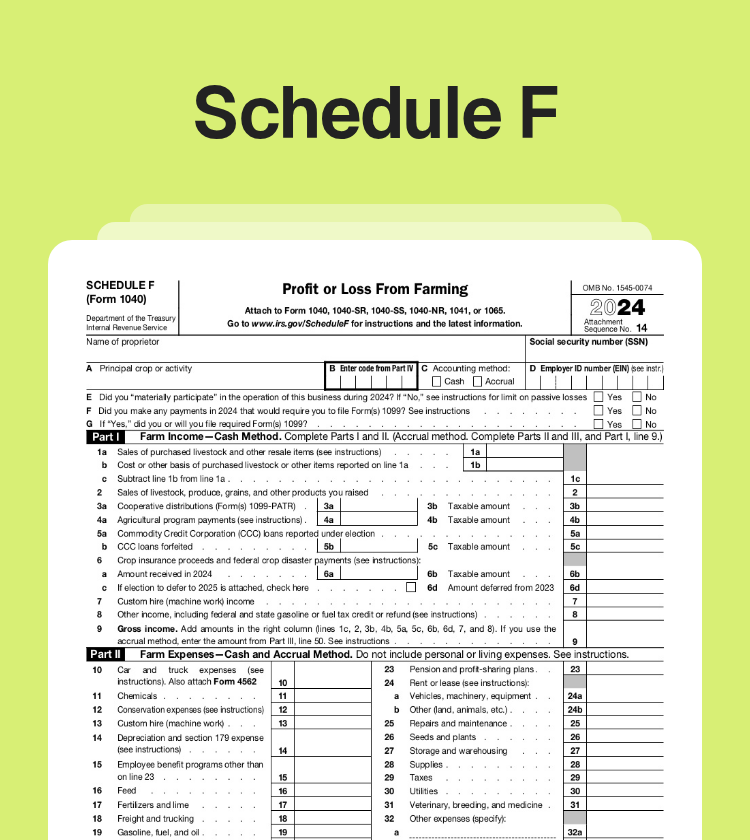

Unlocking Schedule F: Your Complete Guide to Reporting Farm Income and Slashing Taxes in 2026

As tax season kicks off on January 26, 2026, for your 2025 returns, Schedule F (Form 1040) could be your secret weapon for turning farm profits—or even losses—into serious savings. But get it wrong, and you might face audits, penalties, or missed refunds. Whether you’re a full-time farmer, a rancher, or running a small agribusiness,…

-

Schedule C 2026: The Ultimate Guide for Freelancers & Gig Workers – Maximize Deductions, Avoid Costly Mistakes, and Slash Your Tax Bill

As a freelancer, gig worker, Uber driver, consultant, or sole proprietor, you’re the boss — but Uncle Sam still wants his cut. That’s where Schedule C (Form 1040) comes in: your key to reporting business income and expenses, calculating profit or loss, and claiming powerful deductions that can dramatically reduce your taxable income. With the…

-

Biggest Schedule E Rental Property Deductions Every Landlord Should Claim in 2026!

As tax season heats up (filing officially starts January 26, 2026!), rental property owners have a golden opportunity to slash their taxable income. If you report rental income on Schedule E (Form 1040), you’re likely sitting on thousands in deductible expenses that most landlords overlook or misclassify. Rental income is taxable, but the IRS allows…

-

7 Surprising Tax Changes in 2026 That Could Save (or Cost) You Thousands – Are You Ready?

It’s January 2026, your first paycheck with new withholding just hit, and millions of Americans are about to feel the impact of the biggest tax overhaul in years. Thanks to IRS inflation adjustments and the new One Big Beautiful Bill (OBBB), your take-home pay, deductions, and planning strategy could look completely different. Some will save…

-

Maximizing Your Home Office Deduction for 2025: Key Rules and Strategies for Self-Employed Workers

With tax season just around the corner on this December 23, 2025, many freelancers, gig workers, and small business owners are reviewing their deductions to minimize what they owe. One of the most powerful—and often underutilized—tax breaks for those working from home is the home office deduction. If you qualify, this can significantly reduce your…

-

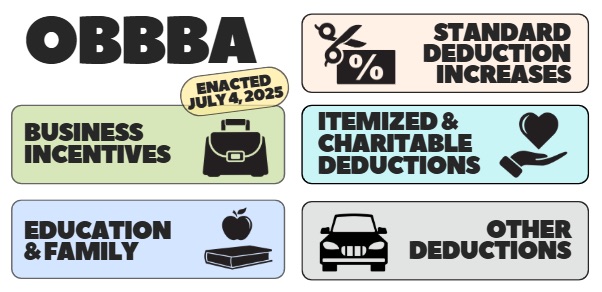

Lesser-Known OBBBA Provisions That Could Save You Big in 2025 – No Tax on Tips, Overtime Deductions, and More

With the One Big Beautiful Bill Act (OBBBA) now fully in effect, much attention has gone to the big-ticket items like permanent TCJA extensions and standard deduction boosts. But buried in the legislation are several targeted provisions that fly under the radar yet offer real savings—especially for workers in service industries, those putting in extra…

-

2025 Tax Law Changes from OBBBA: Key Updates and Year-End Moves to Maximize Savings

The One Big Beautiful Bill Act (OBBBA), signed into law on July 4, 2025, has reshaped the tax landscape by making many popular provisions from the 2017 Tax Cuts and Jobs Act (TCJA) permanent while introducing new deductions and credits. Instead of the feared “TCJA sunset” that would have raised rates and slashed deductions after…

-

Top Tax Deductions for Freelancers: The Ultimate 2025 Guide

Freelancers face a unique tax situation: you’re responsible for your own income tracking, quarterly taxes, and deductions. The good news? Freelancers also have access to powerful tax deductions that can significantly reduce taxable income — if you know what to claim. This guide breaks down the most important tax deductions every freelancer should know for…