Category: Accounting & Bookkeeping

-

7 Key Depreciation Options for Tax Year 2025: Maximize Deductions with 100% Bonus + $2.5M Section 179 (Before It’s Too Late!)

If you’re a small business owner, freelancer, or entrepreneur buying equipment, vehicles, or making improvements in 2025, the tax code just handed you a major win. Thanks to the One Big Beautiful Bill Act (OBBBA) signed in mid-2025, 100% bonus depreciation is back permanently for most assets placed in service after January 19, 2025—and Section…

-

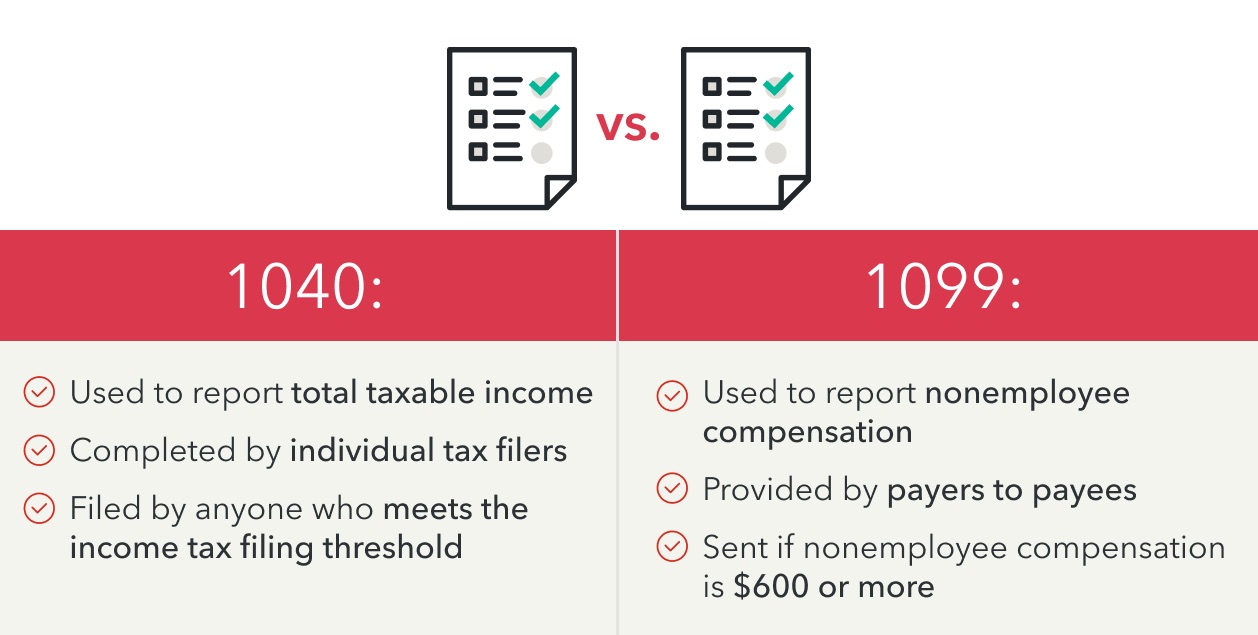

1099 Deadline Alert: February 2, 2026 Is Your Last Chance – Avoid Massive IRS Penalties on 1099-NEC & 1099-MISC!

Tax season is in full swing, and if you’re a small business owner, freelancer, or anyone dealing with independent contractors, the clock is ticking loudly. The key deadline for Form 1099-NEC (Nonemployee Compensation) and most Form 1099-MISC payments is fast approaching—and because January 31, 2026, falls on a Saturday, the IRS automatically shifts it to…

-

Biggest Schedule E Rental Property Deductions Every Landlord Should Claim in 2026!

As tax season heats up (filing officially starts January 26, 2026!), rental property owners have a golden opportunity to slash their taxable income. If you report rental income on Schedule E (Form 1040), you’re likely sitting on thousands in deductible expenses that most landlords overlook or misclassify. Rental income is taxable, but the IRS allows…

-

5 Massive Tax Mistakes That Could Cost You Thousands in the 2026 Filing Season (And How to Avoid Them Before It’s Too Late)

Tax season is officially here—the IRS begins accepting 2025 returns on January 26, 2026, with the deadline looming on April 15. Thanks to the sweeping changes from the One Big Beautiful Bill (signed into law in 2025), millions could see bigger refunds through new perks like no tax on tips, no tax on overtime, no…

-

Why Mixing Personal and Business Finances Is a Tax Mistake

One of the most common tax mistakes among freelancers and small business owners is mixing personal and business finances. While it may seem harmless at first, this habit can lead to accounting errors, lost deductions, and problems if the IRS ever asks questions. What Does “Mixing Finances” Mean? Mixing finances happens when business income or…

-

Top Tax Deductions for Freelancers: The Ultimate 2025 Guide

Freelancers face a unique tax situation: you’re responsible for your own income tracking, quarterly taxes, and deductions. The good news? Freelancers also have access to powerful tax deductions that can significantly reduce taxable income — if you know what to claim. This guide breaks down the most important tax deductions every freelancer should know for…