Author: taxguru

-

Unlock the New $6,000 Senior Tax Deduction in 2026: Could This Slash Your Tax Bill and Change How We View Retirement Income?

As we kick off 2026, millions of Americans over 65 are buzzing about a game-changing tax break that’s putting real money back in their pockets. Introduced under the One Big Beautiful Bill Act, this new $6,000 senior deduction is designed to ease the financial burden on retirees amid rising costs for healthcare, housing, and everyday…

-

The Revival of 100% Bonus Depreciation: A Permanent Win for Businesses in 2026

As we enter the 2026 tax year, one of the most powerful tax incentives for businesses is back—and this time, it’s here to stay. The One Big Beautiful Bill Act (OBBBA), signed into law on July 4, 2025, permanently restored 100% bonus depreciation under IRC Section 168(k). This reversal of the scheduled phase-out from the…

-

7 Surprising Tax Changes in 2026 That Could Save (or Cost) You Thousands – Are You Ready?

It’s January 2026, your first paycheck with new withholding just hit, and millions of Americans are about to feel the impact of the biggest tax overhaul in years. Thanks to IRS inflation adjustments and the new One Big Beautiful Bill (OBBB), your take-home pay, deductions, and planning strategy could look completely different. Some will save…

-

2026 401(k) Limits Just Jumped to $24,500 – Are You Missing Out on Free Tax Savings?

The IRS bumped employee contributions to $24,500 (plus bigger catch-ups for 50+). Maxing this could slash your tax bill by thousands – but only if you act now in January. As we dive into 2026, the IRS has delivered some welcome news for retirement savers: higher contribution limits for 401(k)s, IRAs, and other plans. These…

-

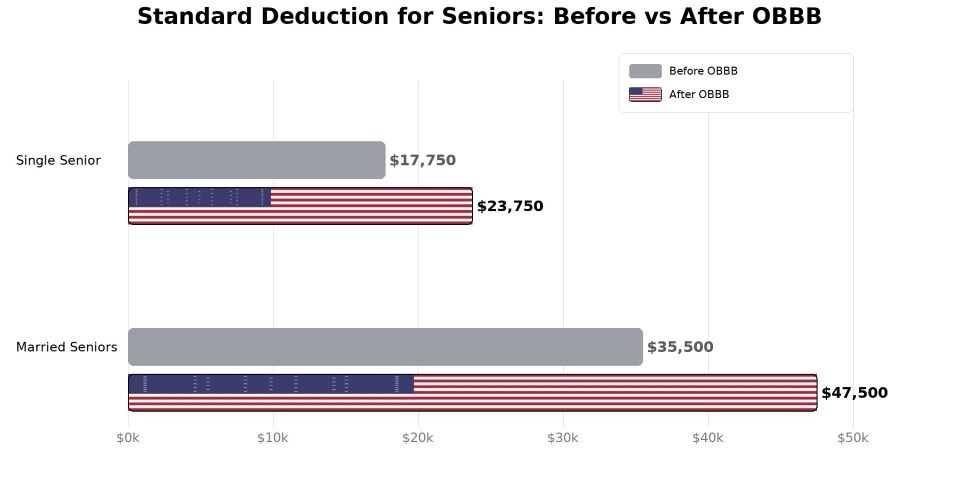

2026 Tax Changes: Will the New Standard Deduction Save You Thousands or Leave You Short?

Happy New Year! As we kick off 2026, major tax updates from the IRS inflation adjustments and the One Big Beautiful Bill Act (OBBBA) are now in effect. The headline change? The standard deduction has jumped significantly, potentially putting more money back in your pocket. But is it a game-changer for everyone—or could it fall…

-

2026 Tax Changes: How Much More Money Will You Keep This Year?

As we ring in 2026, major updates to the U.S. tax code are kicking in—thanks to IRS inflation adjustments and key provisions from the One Big Beautiful Bill Act (OBBBA). These changes could mean bigger paychecks, larger refunds, and more opportunities to save on taxes. But are you positioned to take full advantage? The standard…

-

EV Tax Credits Vanished in 2026? Here’s How to Still Score Big Savings on Your Electric Ride

As we close out 2025 and stare down the barrel of a new tax year, the electric vehicle (EV) landscape has taken a dramatic turn. The federal tax credits that once sweetened the deal on EVs—up to $7,500 for new models and $4,000 for used—officially expired on September 30, 2025, thanks to the One Big…

-

No Tax on Tips in 2026: Will You Actually Get a Bigger Refund This Year?

One of the most talked-about changes from the One Big Beautiful Bill Act (OBBBA) is the new above-the-line deduction for qualified tips (up to $25,000) and overtime premium pay. For millions of service industry workers, bartenders, drivers, and hourly employees, this could mean real money back in their pockets when filing 2025 taxes in early…

-

5 Year-End Tax Moves to Slash Your 2025 Bill Before 2026 Hits

As 2025 draws to a close, the clock is ticking on opportunities to reduce your tax liability for the year. With just days left before December 31, smart, actionable strategies can still make a significant difference—potentially saving you hundreds or even thousands on your 2025 taxes. Thanks to the One Big Beautiful Bill Act (OBBBA),…

-

Last-Minute 2025 Tax Moves That Could Save You Thousands Before December 31 – Don’t Miss Out!

What if you could slash your 2025 tax bill by $5,000 or more in just the next few days? With only hours left until the calendar flips to 2026, there are still powerful, legal strategies you can use right now to lower your taxable income and boost your potential refund next year. Thanks to the…