Author: taxguru

-

2025 Year-End Tax Checklist: 10 Must-Do Moves You Still Need to Review Before Filing in 2026 (Don’t Miss These!)

Missed a 2025 year-end tax strategy? This checklist covers capital loss harvesting, maxing retirement contributions, charitable bunching, and One Big Beautiful Bill changes to lower your 2026 tax bill. Act now!

-

7 Key Depreciation Options for Tax Year 2025: Maximize Deductions with 100% Bonus + $2.5M Section 179 (Before It’s Too Late!)

If you’re a small business owner, freelancer, or entrepreneur buying equipment, vehicles, or making improvements in 2025, the tax code just handed you a major win. Thanks to the One Big Beautiful Bill Act (OBBBA) signed in mid-2025, 100% bonus depreciation is back permanently for most assets placed in service after January 19, 2025—and Section…

-

7 Massive 2025 Tax Changes from the One Big Beautiful Bill – Are You Missing Out on Thousands in Savings?

The “One Big Beautiful Bill Act” (signed into law on July 4, 2025) is already shaking up tax season for millions of Americans. This sweeping legislation makes many 2017 Tax Cuts and Jobs Act provisions permanent, while adding fresh breaks targeted at working families, seniors, and everyday earners. As we head into the 2025 filing…

-

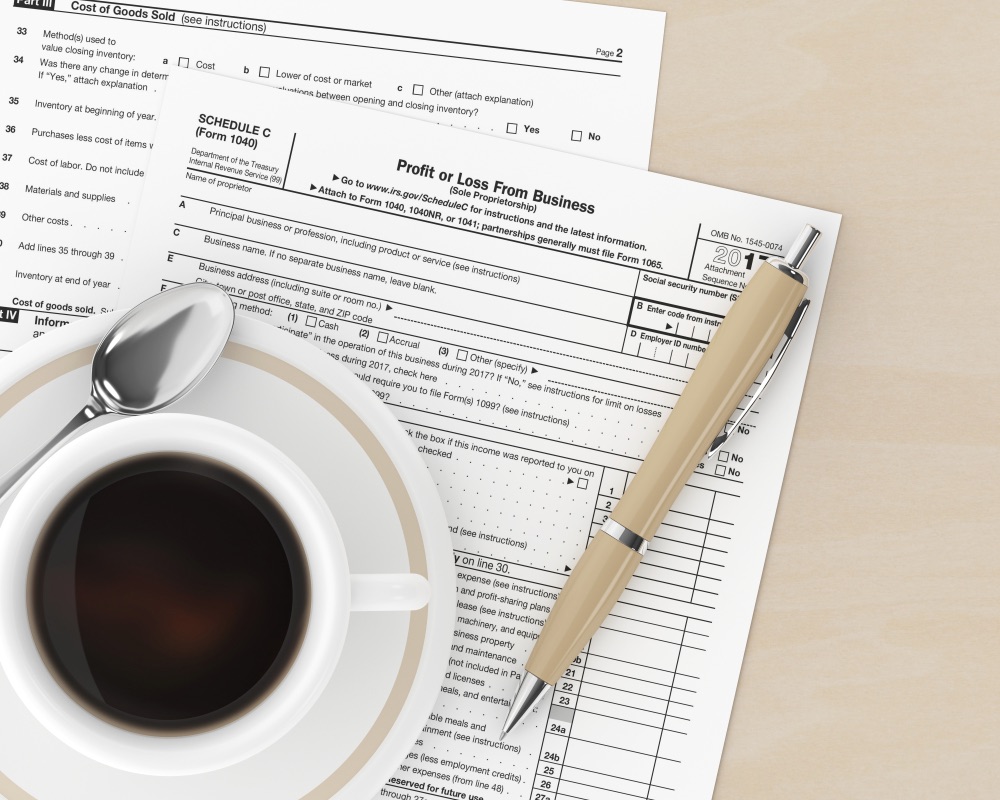

Mastering Schedule C: The Ultimate Guide for Sole Proprietors and Gig Workers in 2025

If you’re running a business as a sole proprietor, freelancer, independent contractor, or gig worker, Schedule C (Form 1040) is essential. This form reports business income and expenses to the IRS, calculating net profit or loss that flows to your individual tax return. Proper completion can unlock significant deductions, reduce taxable income, and minimize self-employment…

-

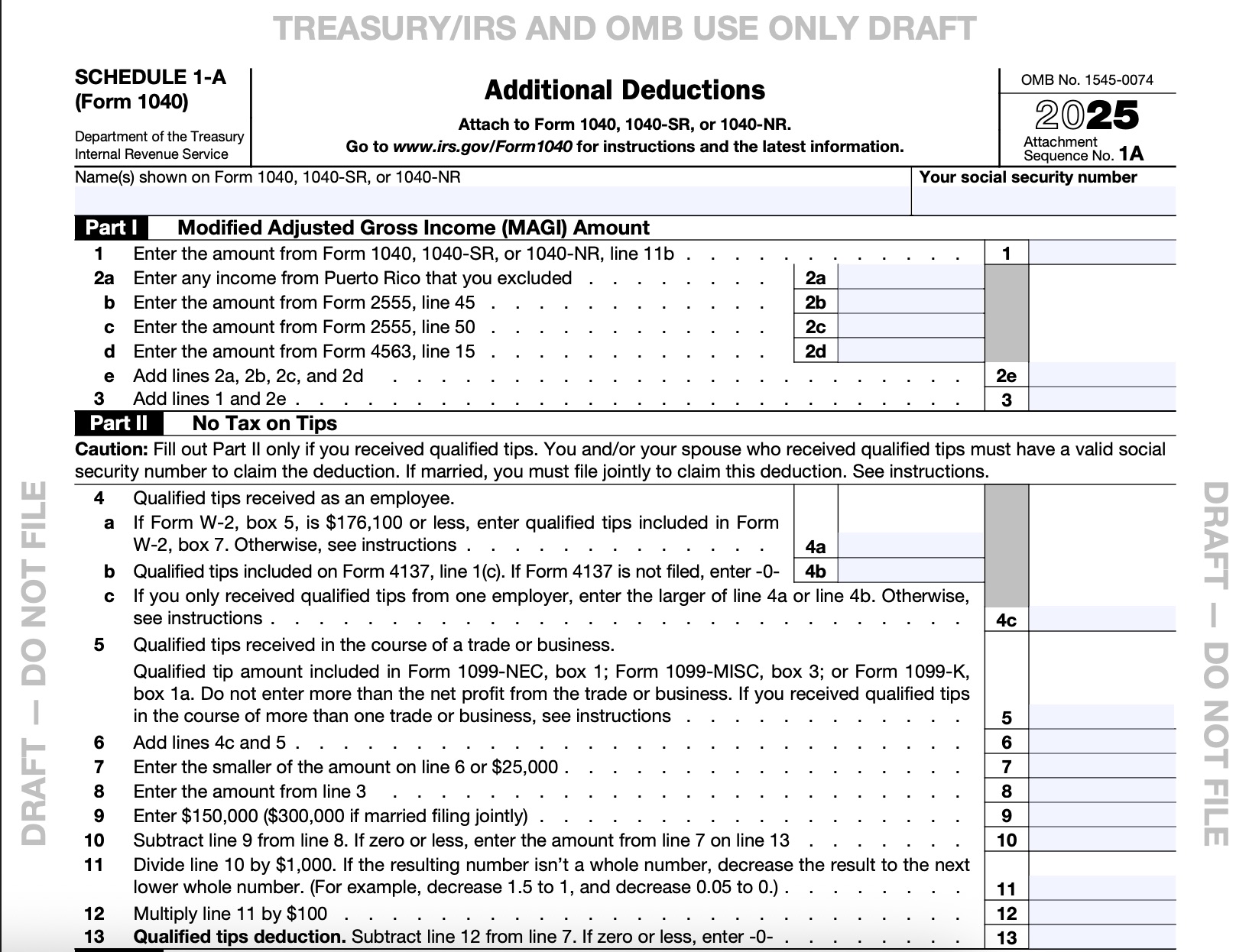

What Is IRS Schedule 1-A? Your Complete 2026 Guide to Claiming No Tax on Tips, Overtime, Car Loans & More (File Your 2025 Return Now!)

Filing your 2025 federal taxes in 2026 just got a major upgrade—and it could mean hundreds or even thousands back in your pocket. The IRS opened the 2026 filing season on January 26, and thanks to the One Big Beautiful Bill (signed into law July 4, 2025), there’s a shiny new form: Schedule 1-A (Form…

-

IRS Free File 2026: File Your 2025 Taxes Completely FREE – Save $50–$150+ This Season (Eligibility, Partners & Step-by-Step Guide)

Tax season kicked off early for many, and with the official 2026 filing opening on January 26, there’s no better time to ditch expensive software fees. IRS Free File is the IRS’s powerhouse program – a partnership with private companies – letting eligible taxpayers prepare and e-file federal returns at zero cost. Last year, millions…

-

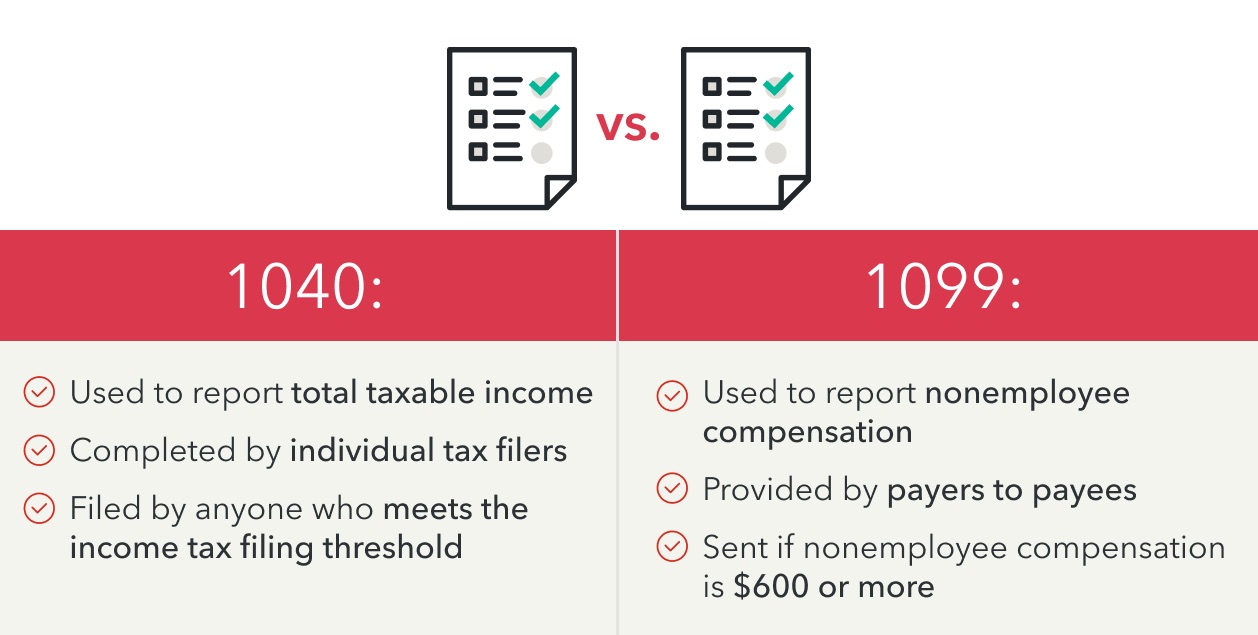

1099 Deadline Alert: February 2, 2026 Is Your Last Chance – Avoid Massive IRS Penalties on 1099-NEC & 1099-MISC!

Tax season is in full swing, and if you’re a small business owner, freelancer, or anyone dealing with independent contractors, the clock is ticking loudly. The key deadline for Form 1099-NEC (Nonemployee Compensation) and most Form 1099-MISC payments is fast approaching—and because January 31, 2026, falls on a Saturday, the IRS automatically shifts it to…

-

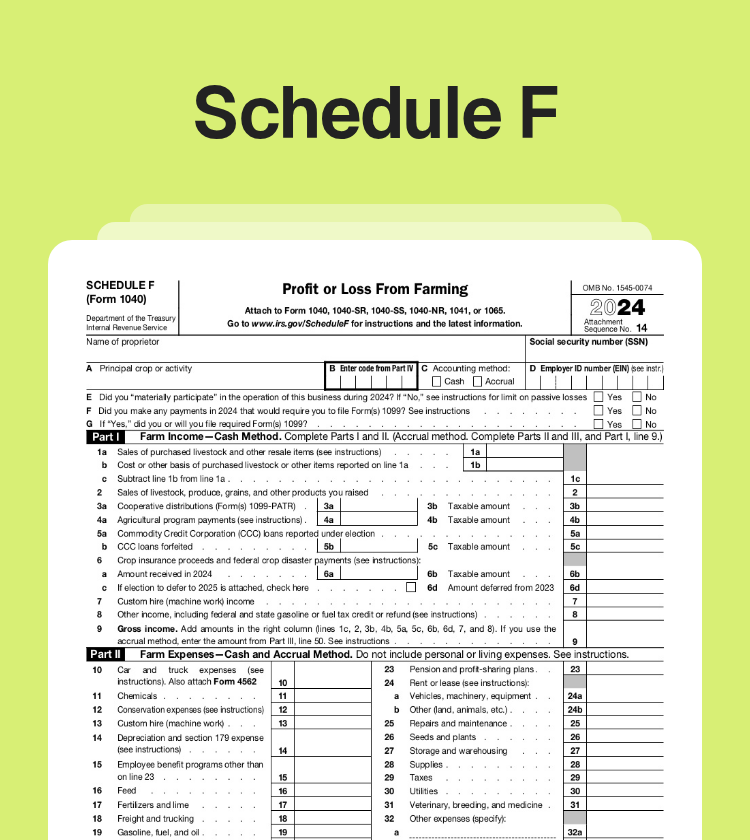

Unlocking Schedule F: Your Complete Guide to Reporting Farm Income and Slashing Taxes in 2026

As tax season kicks off on January 26, 2026, for your 2025 returns, Schedule F (Form 1040) could be your secret weapon for turning farm profits—or even losses—into serious savings. But get it wrong, and you might face audits, penalties, or missed refunds. Whether you’re a full-time farmer, a rancher, or running a small agribusiness,…

-

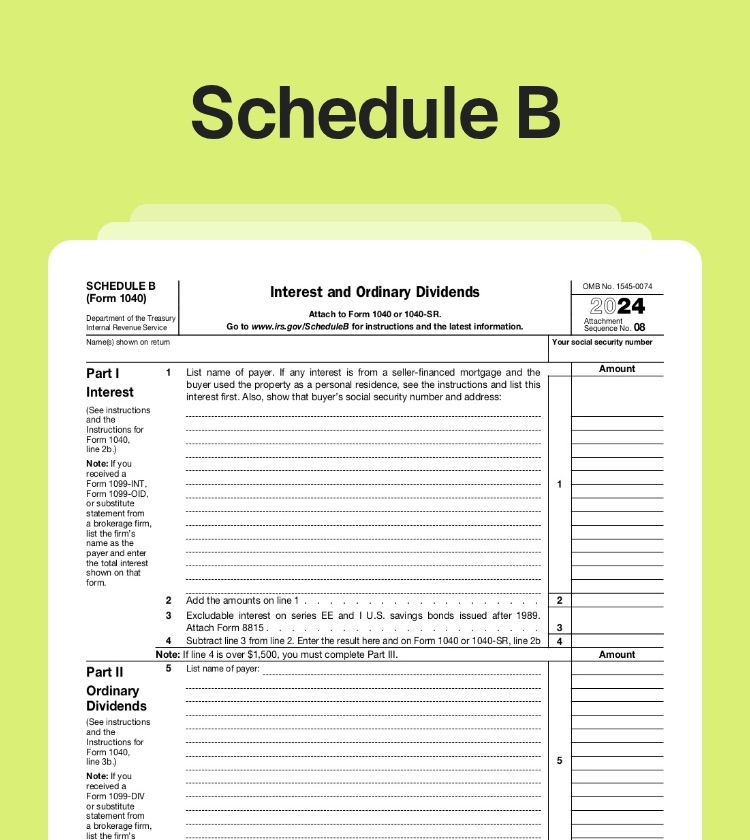

Schedule B Explained: Reporting Interest & Dividends for Tax Year 2025 – And How to Minimize Your Tax Bill

Tax season for 2025 is here (returns due in 2026), and if you’ve got savings accounts earning interest, stocks paying dividends, or even a small foreign account, you might need to file Schedule B (Form 1040). Many people get 1099-INT or 1099-DIV forms in the mail and wonder: “Is this going to complicate my return?”…

-

Schedule C 2026: The Ultimate Guide for Freelancers & Gig Workers – Maximize Deductions, Avoid Costly Mistakes, and Slash Your Tax Bill

As a freelancer, gig worker, Uber driver, consultant, or sole proprietor, you’re the boss — but Uncle Sam still wants his cut. That’s where Schedule C (Form 1040) comes in: your key to reporting business income and expenses, calculating profit or loss, and claiming powerful deductions that can dramatically reduce your taxable income. With the…