As we head into 2026, the IRS has released its annual inflation adjustments for federal income tax brackets, standard deductions, and other key provisions. Thanks to the One Big Beautiful Bill Act (OBBBA) passed in 2025, many of the popular tax cuts from the 2017 Tax Cuts and Jobs Act (TCJA) are now permanent—including the seven progressive tax rates and wider brackets that help prevent “bracket creep.”

But with inflation still a factor, the income thresholds have shifted upward. This means many taxpayers could stay in a lower bracket longer, potentially owing less than expected. On the flip side, if your income is rising faster than these adjustments, you might edge into a higher rate. Let’s break it down and see how these changes could impact your wallet in 2026 (for returns filed in 2027).

Key Highlights for 2026

• Standard Deduction Increases: Up to $16,100 for singles and $32,200 for married couples filing jointly—a modest bump to keep pace with inflation after the bigger OBBBA boost in 2025.

• Tax Rates Stay the Same: The seven brackets remain 10%, 12%, 22%, 24%, 32%, 35%, and 37%, now made permanent.

• Higher Retirement Limits: 401(k) contributions max out at $24,500 (plus catch-ups), encouraging more tax-deferred savings.

• Ongoing Senior Relief: The temporary $6,000 additional deduction for those 65+ (from OBBBA) continues through 2028, on top of the regular extra standard deduction.

These adjustments aim to shield middle-income earners from inflation-driven tax hikes, but high earners in costly areas might feel less relief.

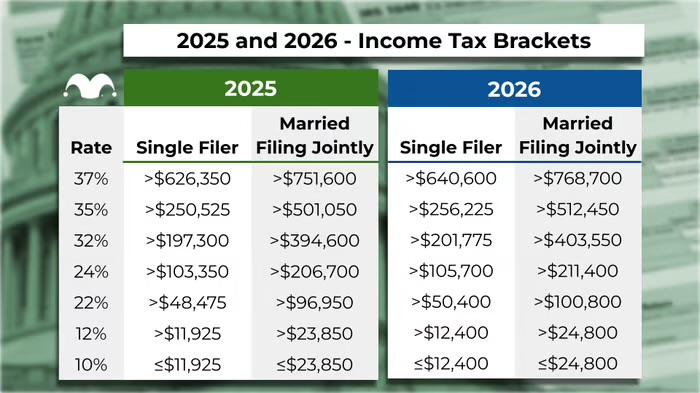

The 2026 Federal Tax Brackets

Here’s a clear comparison of the 2026 brackets (taxable income after deductions):

(Note: These are approximate based on IRS inflation adjustments; exact figures in Revenue Procedure 2025-32.)

Compared to prior years, the brackets are wider in the lower rates due to targeted OBBBA adjustments, benefiting working families most.

Standard Deduction: Your Built-In Tax Break

The standard deduction is jumping slightly for 2026:

• Single or Married Filing Separately: $16,100

• Married Filing Jointly: $32,200

• Head of Household: $24,150

For seniors (65+), add the ongoing extra amount (~$2,050 single / $1,650 per spouse joint in 2026 estimates) plus the temporary OBBBA $6,000 deduction (phasing out at higher incomes). This could mean thousands in extra savings for retirees!

Who Benefits Most—and Who Might Pay More?

• Middle-Income Winners: With wider low-end brackets and higher deductions, many in the 12%–24% range will keep more money, especially if maximizing retirement contributions (now up to $24,500 for 401(k)s + $7,500 for IRAs).

• High Earners: The top 37% kicks in later ($640,600+ single), but limited itemized benefits (e.g., partial Pease-like limits reinstated for 37% bracket) could offset gains.

• Bracket Creep Risk: If your raise outpaces ~2-4% inflation adjustments, you might owe more. Thought provoker: Is this “silent tax hike” still lurking for high-cost-of-living states?

Action Steps for 2026 Planning

1. Estimate Your Bracket: Use the IRS withholding estimator or a tax calculator with these new numbers.

2. Boost Retirement Savings: Max out that $24,500 401(k) limit to lower taxable income now.

3. Seniors: Don’t miss the stacked deductions—could slash your bill significantly.

4. Year-End Moves: Adjust withholding, bunch deductions, or harvest losses before December 31.

The OBBBA’s permanence provides stability, but these annual tweaks remind us: Tax planning pays off. What’s your projected 2026 bracket? Drop it in the comments—I’d love to hear how these changes hit your household!

Disclaimer: This is general information; consult a tax professional for personalized advice. Sources: IRS Revenue Procedure 2025-32 and related announcements.

Share this if it helped—let’s get everyone ready for a smarter tax year! 🚀

Leave a Reply