Happy New Year! As we kick off 2026, major tax updates from the IRS inflation adjustments and the One Big Beautiful Bill Act (OBBBA) are now in effect. The headline change? The standard deduction has jumped significantly, potentially putting more money back in your pocket. But is it a game-changer for everyone—or could it fall short amid rising costs?

Let’s break it down and see how these shifts could impact your wallet when you file in 2027.

The Big Jump in Standard Deduction

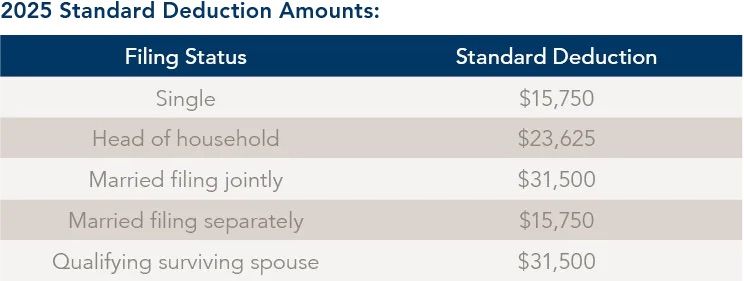

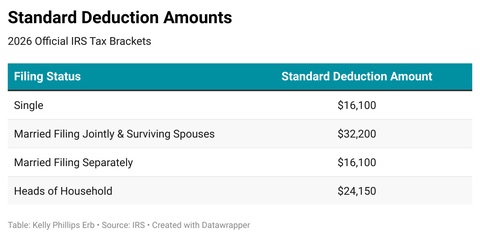

For 2026, the IRS has increased the standard deduction to:

• $16,100 for single filers and married filing separately (up from $15,750 in 2025)

• $32,200 for married couples filing jointly (up from $31,500)

• $24,150 for heads of households

This adjustment helps shield more of your income from taxes right off the bat. Thanks to OBBBA making many TCJA provisions permanent, these higher deductions are here to stay, with annual inflation tweaks.

Quick Example Calculator:

Suppose you’re a married couple filing jointly with $100,000 in gross income and no other adjustments.

• Taxable income with 2025 deduction: $100,000 – $31,500 = $68,500

• Taxable income with 2026 deduction: $100,000 – $32,200 = $67,800

That’s an extra $700 shielded from taxes. In the 22% bracket, that’s about $154 in savings—not thousands, but it adds up, especially if you’re not itemizing.

For many middle-income families, this could mean a noticeably bigger refund or lower tax bill. But will it “save you thousands”? Only if you’re on the cusp of a bracket or have moderate income. High earners might see minimal impact.

Extra Boost for Seniors

If you’re 65 or older, OBBBA adds a temporary $6,000 additional deduction per qualifying individual (through 2028). Combined with the regular senior adjustment (~$1,650–$2,050 depending on filing status), this could push savings higher for retirees.

Biggest Winners in 2026 Taxes

The standard deduction shines for those who don’t itemize—which is about 90% of filers post-TCJA. Winners include:

• Middle-class families in moderate-tax states

• Renters or homeowners with low mortgage interest

• Anyone with simple finances (no massive charitable donations or medical expenses)

OBBBA also restored 100% bonus depreciation permanently for business assets. Business owners investing in equipment? You can deduct the full cost upfront—huge for cash flow.

High-tax state residents get relief too: The SALT (state and local tax) deduction cap rises to around $40,400 (indexed), with phaseouts for very high earners. This could flip the script, making itemizing worthwhile again for some in California, New York, or New Jersey.

Other perks:

• Annual gift exclusion holds at $19,000 per recipient

• Estate tax exemption jumps to $15 million individual / $30 million couples

Hidden Losers Under OBBBA

Not everyone benefits equally:

• High itemizers: If your deductions (mortgage interest, charity, etc.) were already high, the bigger standard might not help—and SALT phaseouts could bite if your MAGI exceeds ~$505,000.

• Service workers: “No tax on tips” provides a deduction up to $25,000, but it’s limited to certain occupations and phases out for higher earners.

• Inflation chasers: While deductions rose, if your costs (groceries, housing) outpace this ~2-3% bump, it might feel like treading water.

Personal exemptions remain $0, so families relying on those pre-2018 won’t see a comeback.

Should You Itemize or Take the Standard?

Run the numbers! If your itemized total (SALT + mortgage interest + charity + medical over 7.5% AGI) exceeds the new standard, itemize for bigger savings. Tools like tax software can help simulate.

Final Thoughts: Plan Now for Bigger Savings

The 2026 changes lock in lower rates and bigger deductions long-term, but proactive steps amplify benefits:

• Max retirement contributions

• Bunch charitable gifts if itemizing

• Business owners: Accelerate equipment purchases for 100% bonus depreciation

What’s your filing status, and do you think the new standard deduction will boost your refund? Are you in a high-tax state benefiting from expanded SALT? Drop a comment below—I’d love to hear your take and help crunch the numbers!

If you’re worried about owing more (or missing savings), consult a tax pro early. These changes are a solid win for most, but personalized advice ensures you maximize them.

Stay tuned for more 2026 tax breakdowns. Here’s to a prosperous (and lower-taxed) year! 🚀

Sources: IRS Revenue Procedure 2025-32 and OBBBA provisions. All figures subject to final IRS guidance.

Leave a Reply