The IRS has just unveiled the official 2026 tax brackets and inflation adjustments, incorporating key changes from the One Big Beautiful Bill Act (OBBBA). If your income doesn’t skyrocket with inflation, you could see a slightly larger paycheck—or a smaller tax bill—thanks to wider brackets and a boosted standard deduction.

But here’s the thought-provoking question: Will these adjustments truly offset rising costs, or will inflation quietly erode your gains? Let’s break it down with clear comparisons, real-world implications, and tips to maximize your money in 2026.

Key 2026 Changes at a Glance

The lower tax brackets got a bigger inflation boost (~4%) compared to higher ones (~2.3%), putting more money in the pockets of middle- and lower-income earners. The standard deduction also rises, meaning most Americans (about 90%) won’t need to itemize to get a solid break.

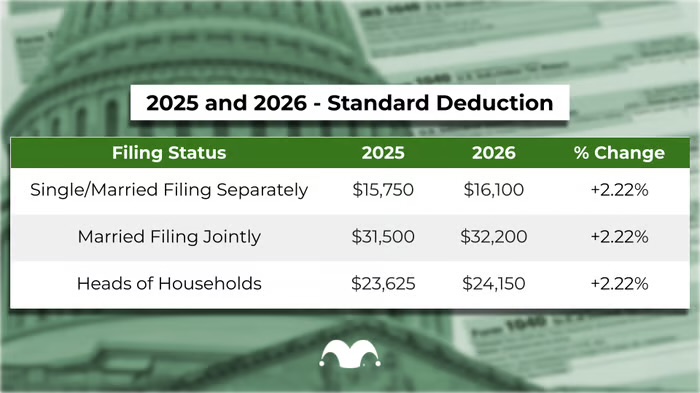

2026 Standard Deduction Amounts

Plus, seniors (65+) get an extra boost: the usual additional amount (~$1,650–$2,050 depending on status) plus a new temporary $6,000 senior deduction (up to $12,000 for joint filers where both qualify), phasing out at higher incomes.

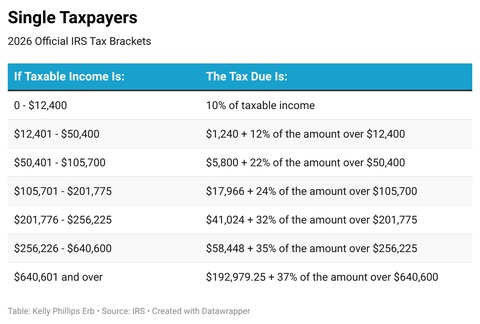

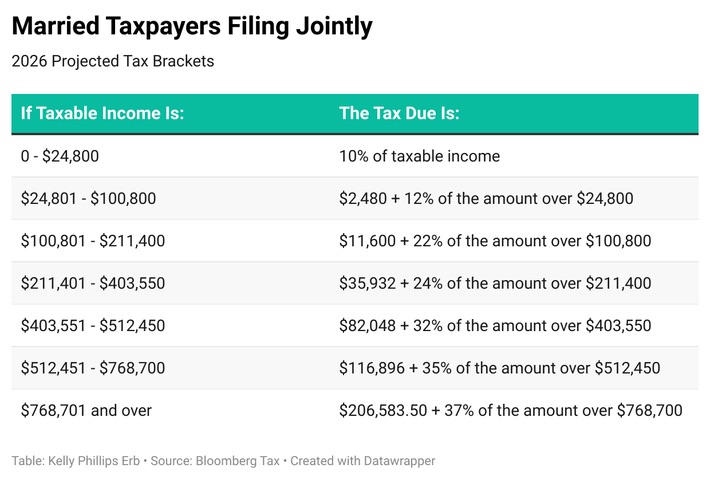

2026 Federal Tax Brackets

Rates stay the same (10% to 37%), but thresholds shift upward.

For Single Filers:

For Married Filing Jointly:

Why This Could Mean Bigger Paychecks

• Bracket Creep Protection: Wider ranges mean you can earn more before hitting a higher rate. If your salary rises only with inflation (~2-3%), you’ll likely stay in the same bracket.

• Higher Standard Deduction: Subtract more from your income before taxes apply. For a married couple, that’s an extra $700 shielded from taxes—potentially $150–$250 saved depending on your rate.

• OBBBA Bonuses Kicking In: No tax on up to $25,000 in qualified tips, overtime premium pay deductions, and that senior bonus could stack for even bigger savings.

The Big Question: Will Inflation Wipe Out the Gains?

Experts note these adjustments lag behind real inflation (which hit ~2.7% recently). If costs for groceries, housing, or gas rise faster than your wages, the “bigger paycheck” might feel smaller in your wallet. It’s a classic debate: Are these changes a meaningful relief for working families, or just a band-aid on broader economic pressures?

Action Steps to Maximize Your 2026 Taxes

1. Update Your W-4 Now: Adjust withholding to reflect wider brackets and new deductions—avoid overpaying the IRS all year.

2. Track Tips/Overtime: If eligible, document everything for the new deductions (up to massive savings!).

3. Seniors: Don’t miss the $6,000 bonus—it’s temporary (2025–2028).

4. Run the Numbers: Use the IRS withholding estimator or consult a pro to see your personal impact.

These changes could put real money back in your pocket—but only if you plan ahead. What do you think: Game-changer or not enough? Share in the comments, and subscribe for more timely tax insights to help your finances thrive in 2026! 🚀

Leave a Reply