The IRS bumped employee contributions to $24,500 (plus bigger catch-ups for 50+). Maxing this could slash your tax bill by thousands – but only if you act now in January.

As we dive into 2026, the IRS has delivered some welcome news for retirement savers: higher contribution limits for 401(k)s, IRAs, and other plans. These inflation-adjusted increases mean you can shield more of your income from taxes while building a stronger financial future. But with costs still rising and retirement looming for many, is this boost enough—or should you be doing even more?

Let’s break down the key changes, why they matter, and how you can make the most of them right now.

The Big Numbers: What’s New for 2026?

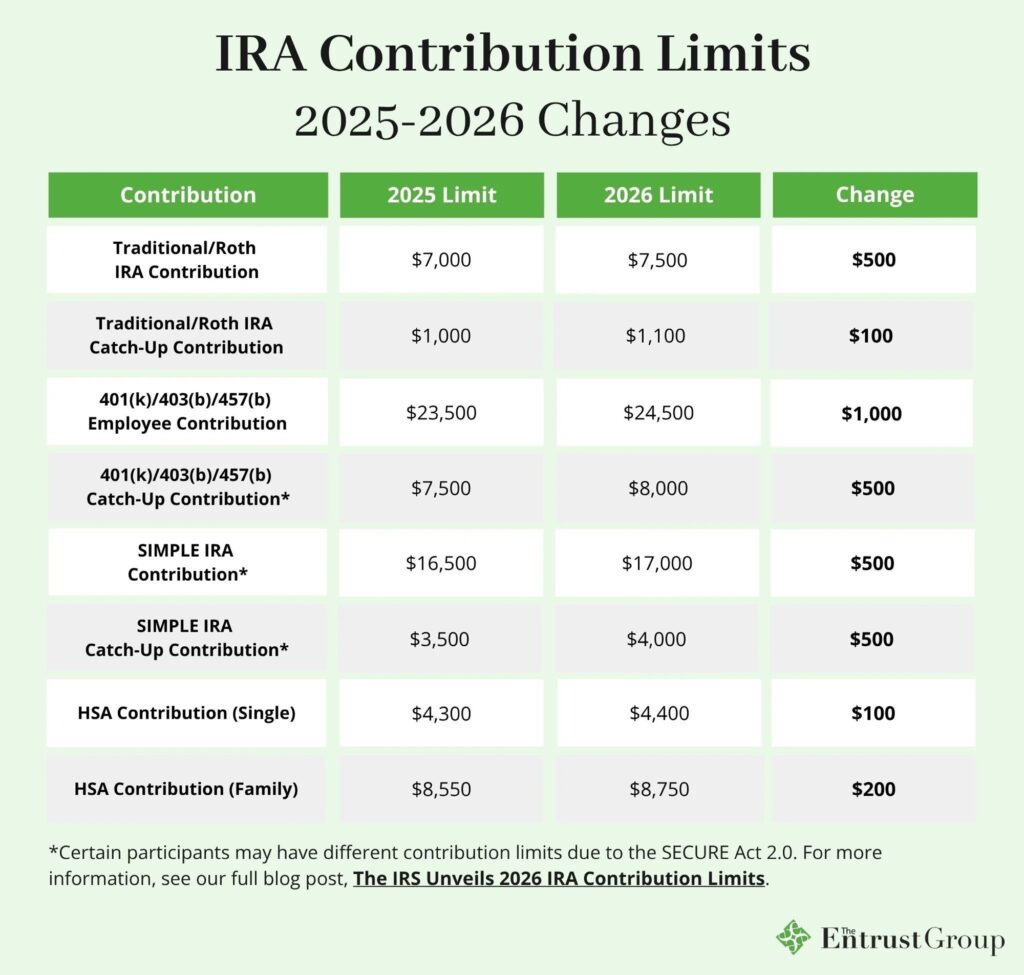

The IRS announced these updates in late 2025, giving you plenty of time to adjust your payroll deductions before the year gets underway. Here’s a quick comparison:

These limits apply to popular plans like 401(k)s, 403(b)s for nonprofits, governmental 457s, and the federal Thrift Savings Plan. For high earners (prior-year wages over $150,000), a new SECURE 2.0 rule kicks in: catch-up contributions must generally be made as Roth (after-tax) – more on that below.

Why This Matters: Tax Savings That Feel Like a Raise

Contributing to a traditional 401(k) or IRA reduces your taxable income dollar-for-dollar. In a 24% tax bracket, maxing out the $24,500 401(k) limit could save you about $5,880 in federal taxes alone (plus state savings in most places).

Think of it this way: That extra $1,000 limit increase? It’s like getting a $1,000 bonus – but tax-free growth for decades.

For example:

• A 45-year-old earning $100,000 who boosts contributions by $1,000 saves ~$240-$320 in taxes this year (depending on bracket).

• Over 20 years at 7% average returns, that extra $1,000 could grow to over $3,800.

And if you’re 50+? The bumped catch-up means even more shielded income. Those in their 60s with the super catch-up can turbocharge their nest egg in the final stretch before retirement.

Roth vs. Traditional: Which Should You Choose?

• Traditional: Pre-tax contributions lower your taxes now – ideal if you expect a lower bracket in retirement.

• Roth: After-tax contributions, but tax-free withdrawals later. Great if you anticipate higher taxes or want flexibility.

New twist for 2026: High earners (over $150k prior year) must make catch-ups as Roth in employer plans. If your plan doesn’t offer Roth options, check alternatives like a backdoor Roth IRA.

Thought-Provoking Angle: Is Maxing Retirement the Smartest “Raise” You Can Give Yourself?

With inflation cooling but everyday costs (housing, healthcare, education) still elevated, many Americans feel squeezed. Yet, only about 14% max out their 401(k)s each year. Why?

• Life gets in the way: Emergencies, debt, or just forgetting to increase contributions.

• But here’s the provocation: Automating even a small increase now compounds massively. Contributing the full $24,500 annually from age 30 could build over $1 million by 65 (assuming 7% returns – historical stock market average).

In a world of uncertain Social Security and longer lifespans, relying on employer matches alone isn’t enough. These higher limits aren’t just numbers – they’re an opportunity to take control.

Practical Tips to Maximize 2026 Savings

1. Act in January: Update your payroll deductions ASAP. Many plans let you set percentage-based contributions that auto-increase with raises.

2. Automate It: Set contributions to hit the max spread over paychecks – you won’t miss what you don’t see.

3. Check Employer Match: Free money! Aim for at least enough to get the full match (often 4-6% of salary).

4. Roth Catch-Up Alert: If affected, confirm your plan has Roth options or explore IRAs.

5. Phase-Outs Matter: For deductible traditional IRAs or Roth eligibility, income limits rose slightly (e.g., traditional IRA phase-out for singles with workplace plan: $81,000-$91,000).

6. Don’t Forget HSAs or Other Accounts: If eligible, triple tax-advantaged HSAs are another powerhouse.

Final Thoughts: Your 2026 Goal Starts Today

The IRS’s 2026 adjustments are a solid win, but they’re most powerful when you use them. Whether you’re just starting or racing toward retirement, increasing contributions now could be the best financial move of the year.

What’s your 2026 contribution goal? Are you aiming to max out, increase a little, or finally start catching up? Drop your plan in the comments below – let’s motivate each other! And if you found this helpful, share it with a friend who needs a retirement wake-up call.

Sources: IRS Notice 2025-67 and official announcements. Tax situations vary – consult a professional for personalized advice.

Leave a Reply