Tax season is in full swing, and if you’re a small business owner, freelancer, or anyone dealing with independent contractors, the clock is ticking loudly. The key deadline for Form 1099-NEC (Nonemployee Compensation) and most Form 1099-MISC payments is fast approaching—and because January 31, 2026, falls on a Saturday, the IRS automatically shifts it to the next business day: Monday, February 2, 2026.

Missing this deadline isn’t just a minor oversight. Late filings trigger steep penalties that start at $60 per form and can climb to $130, $340, or even $660+ per form if the delay is intentional or you’re way past due. In a worst-case scenario, the IRS could impose backup withholding at 24% on future payments to that vendor. Ouch.

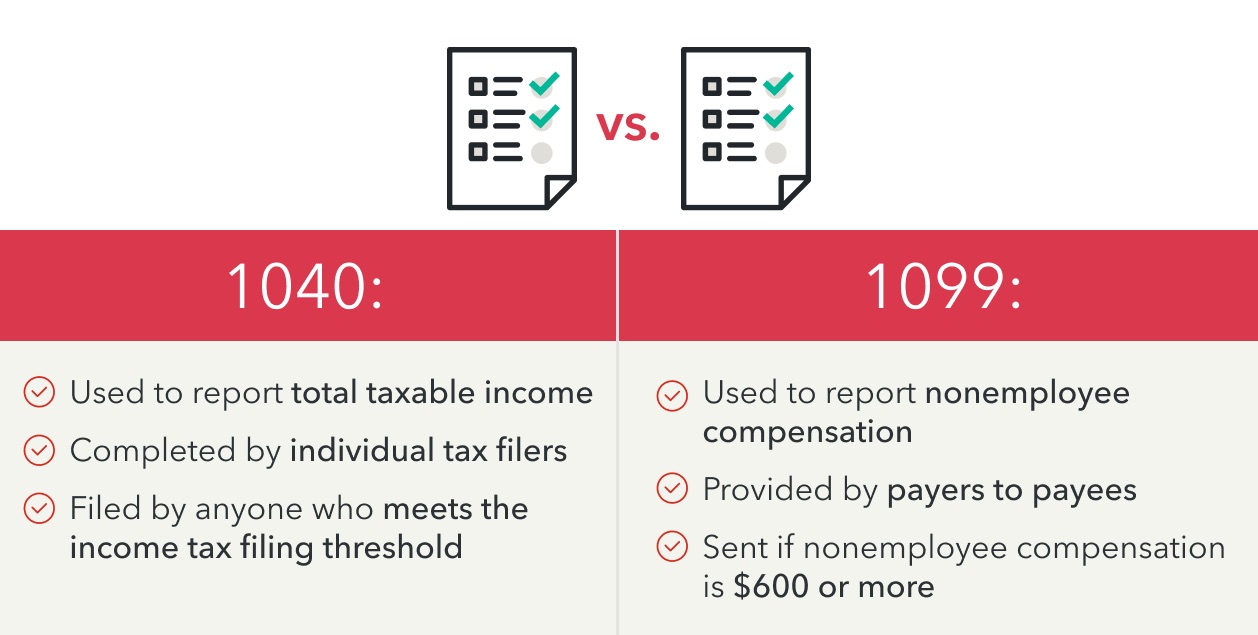

Whether you’re issuing 1099s as a small business payer or expecting them as an individual recipient (like a freelancer, consultant, or gig worker), here’s everything you need to know to stay compliant, avoid headaches, and potentially save thousands in penalties and stress.

Who Needs to Issue 1099 Forms in 2026 (for 2025 Payments)?

• Small Businesses & Payers: If your business paid $600 or more in 2025 to a non-employee (independent contractor, freelancer, consultant, attorney fees, etc.) for services, you must issue Form 1099-NEC.

• For other miscellaneous payments—like rent, prizes/awards, royalties, or certain settlements—use Form 1099-MISC if the total hits $600+.

• Important note: The $600 threshold still applies for payments made in 2025 (filed now in 2026). Thanks to the One Big Beautiful Bill Act (signed in 2025), the threshold jumps to $2,000 for payments starting in 2026 (filed in 2027)—a huge relief for businesses with lots of small vendors!

Even if you paid just over the threshold to one contractor, or spread payments across the year, it all adds up. And remember: The form must be accurate—wrong TINs (Taxpayer Identification Numbers), misspelled names, or using the wrong form (NEC vs. MISC) can lead to rejected filings and penalties.

Key Deadlines You Can’t Ignore

• To Recipients (Contractors/Freelancers): Furnish Copy B of Form 1099-NEC (and most 1099-MISC) by February 2, 2026. This gives them time to prepare their own tax returns.

• To the IRS:

• Form 1099-NEC: File (paper or electronic) by February 2, 2026—no extension for e-file here!

• Form 1099-MISC (most boxes): Furnish to recipients by Feb 2; file with IRS by March 2, 2026 (paper) or March 31, 2026 (electronic).

• E-File Mandate: If you have 10 or more information returns (including 1099s, W-2s, etc.), you must e-file—paper filings will be rejected.

• Special cases (like 1099-MISC for certain boxes like 8 or 10) may have a later recipient deadline of February 17, 2026.

Pro tip: Start early! Many businesses aim to finish by late January to account for mailing delays or e-file processing.

For Individuals & Freelancers: What If You Don’t Receive a 1099?

Here’s the harsh truth: You still have to report ALL income on your tax return—even if your client “forgets” to send a 1099-NEC. The IRS matches forms against your return, and discrepancies can trigger audits or notices.

• Track every payment yourself (invoices, bank statements, apps like PayPal/Venmo).

• If you earned $400+ in net self-employment income, you owe self-employment tax regardless.

• Expect your 1099-NEC soon after Feb 2—use it to double-check your records.

Gig workers and side-hustlers: This is your reminder that “no form = no tax” is a myth that costs people big during audits.

Common Mistakes That Trigger Penalties (And How to Avoid Them)

1. Wrong Form: Using 1099-MISC for contractor services instead of 1099-NEC.

2. Bad TINs: Always collect a W-9 at onboarding and validate TINs (use IRS TIN Matching tool).

3. Late or Incomplete Filing: Penalties escalate fast—file early!

4. Ignoring State Rules: Some states have their own 1099 requirements or lower thresholds.

5. No Backup Withholding: If a vendor doesn’t provide a TIN, you may need to withhold 24%.

How to Get This Done Quickly & Painlessly

• Use IRS-approved software or services (like TaxBandits, QuickBooks, or Xero) for easy prep, e-filing, and recipient delivery.

• Gather W-9s now if you haven’t.

• Double-check totals and classifications.

• File electronically for speed and compliance.

The bottom line? February 2, 2026, is closer than you think. Get your 1099s handled this week to avoid the rush—and the penalties.

Ready for more daily tax tips? Subscribe below for upcoming TTOTD (Tax Tip of the Day) insights, and alerts on 2026 changes. Drop a comment: Are you issuing 1099s this year, or waiting on one? What’s your biggest 1099 headache? Let’s discuss!

Stay compliant, stay ahead. Your wallet (and the IRS) will thank you. 🚀

#1099Deadline #TaxTips #SmallBusinessTaxes #Freelancers #1099NEC #2026Taxes

Leave a Reply